Research Article

Volume 2 Issue 5 - 2018

Understanding the Mind of the Consumer with Regard to OTC Products: Sleep-Aids

1Mind Genomics Advisors, LLC

2Ad Flurry, Inc

2Ad Flurry, Inc

*Corresponding Author: Howard Moskowitz, Mind Genomics Advisors, LLC, India.

Received: June 06, 2018; Published: June 25, 2018

Abstract

This paper introduces a new approach to understand the mind of the consumer, the science of Mind Genomics. Mind Genomics uses experimental design to mix together ideas of different types for a topic, present these mixtures to respondents, obtain ratings of the combination on a response scale, and deconstruct the ratings into the contributions of the components. Mind Genomics reveals how people make decisions about products and services by presenting the combinations in a way that make the answers hard to ‘game.’ The paper presents the application of Mind Genomics to understanding over-the-counter Sleep-Aids that could be purchased in a pharmacy. The paper is the first in a series of investigation of such pharmacy products, moving beyond the world of prescription drugs into the world of health-aids.

Introduction

As companies in the world becoming increasingly competitive, and as markets fracture to admit many competitors rather than just one big entry, what consumers ‘want’ is becoming an important factor. More than ever, companies can reach consumers by different channels. Consumer loyalty is a thing of the past for many products, as companies view to lure consumers to their products through price, and messaging.

Understanding the messages is important. Just what does one say to a consumer? Furthermore, how does one discover what to say in a world where there are many consumer ‘types’ mind-sets of individuals responding to different aspects of the message. This issue has been dealt with for many years by consumer researchers, promoting one or another survey method (Christensen., et al. 2014), virtual shopping experience (Burke, 1997), and even moving as far as to use neurophysiological methods (Genco., et al. 2013). There are other methods of a deeper nature, such as in-depth interviews (Minichiello., et al. 1990), semiotics (Mick., et al. 2004), and the like.

We introduce here the science of Mind Genomics, a structured system which creates a body of integrated knowledge about how relevant messages in a topic area, here Sleep-Aids, can help to understand the mind of the customer at the level of knowledge, and can drive sales at the level of business. The study explicates the method in depth, showing how the experiment is set up, run, and resulting data analyzed.

Mind Genomics itself can be traced to the application of a method called conjoint analysis. Simply stated, conjoint analysis mixes together ideas, gets responses, and determine the contribution of the components from the response to the combination. It was originally proposed by mathematical psychologists Luce and Tukey [1964], more than a half century ago, in the Journal of Mathematical Psychology, presented as a form of fundamental measurement. Conjoint analysis is simple to functional measurement suggested by psychological Norman Anderson [1970]. The early work on conjoint analysis was theoretical but was simplified by Wharton professors Paul Green and Jerry Wind in the 1970’s (Green., et al. 2001). The author and his colleagues moved beyond those efforts to create a science called Mind Genomics [Gofman., et al. 2013; Moskowitz., et al. 2007, Moskowitz., et al. 2005]. The early work on Mind Genomics has been further clarified and expanded by other authors, e.g., Milutinovic and Salom [2016].

The consumer situation

This paper is a foundational explanation of the principles of that science, applied to the problem of an over the counter Sleep-Aid. Anyone who suffers from insomnia knows how precious a good night sleep can be, and often how unattainable. The sufferer paces all night, or if not, then waits for sleep to arrive, and hopes to remain asleep for several hours. In the worst of cases the sleep is repeatedly interrupted, with bouts of waking, sometimes calling forth the diagnosis of the dangerous sleep condition called apnea, a condition that has to be medically treated. For many others, however, the situation is not quite as serious, does not call for a medical checkup and diagnosis, but merely some type of Sleep-Aid. Over the counter Sleep-Aids are abundant, either directly marketed as Sleep-Aids, or as diet supplements that have sleep properties, such as valerian.

This paper is a foundational explanation of the principles of that science, applied to the problem of an over the counter Sleep-Aid. Anyone who suffers from insomnia knows how precious a good night sleep can be, and often how unattainable. The sufferer paces all night, or if not, then waits for sleep to arrive, and hopes to remain asleep for several hours. In the worst of cases the sleep is repeatedly interrupted, with bouts of waking, sometimes calling forth the diagnosis of the dangerous sleep condition called apnea, a condition that has to be medically treated. For many others, however, the situation is not quite as serious, does not call for a medical checkup and diagnosis, but merely some type of Sleep-Aid. Over the counter Sleep-Aids are abundant, either directly marketed as Sleep-Aids, or as diet supplements that have sleep properties, such as valerian.

In this first study of the OTC world of products, we investigated a prospective commercial product as a Sleep-Aid. In this study, as in most of the studies of our effort in OTC, we wanted to put the principles of Mind Genomics into practice, so the studies to be reported would have a commercial flavor. We were fortunate to link up with Mr. Charles Stebbins of Tampa, Florida, who helped in bring our efforts out from the laboratory, and into the commercial world. And so, this first experiment was done to explore the world in which this Sleep-Aid would compete.

Setting up the Mind Genomics study for Sleep-Aid – silos and elements

As we approached the issue of Sleep-Aids, it became clear that the principles of Mind Genomics would remain the same, whether we were attempting to understand the search for a better sleep (the respondent’s goal), or the response to messages about a product that might help one sleep better (the trade or distributor’s goal). Most of the research in this series studies using Mind Genomics involved basic science, the attempt to understand small slices of everyday life through experimental design of ideas. At the same time, it seemed perfectly reasonable that one could apply these principles and the ensuing understanding to the task of communicating and selling.

As we approached the issue of Sleep-Aids, it became clear that the principles of Mind Genomics would remain the same, whether we were attempting to understand the search for a better sleep (the respondent’s goal), or the response to messages about a product that might help one sleep better (the trade or distributor’s goal). Most of the research in this series studies using Mind Genomics involved basic science, the attempt to understand small slices of everyday life through experimental design of ideas. At the same time, it seemed perfectly reasonable that one could apply these principles and the ensuing understanding to the task of communicating and selling.

Mind Genomics works on the basis of silos, basic groups of ideas, and on the basis of elements, the actual ideas. Typically, the elements are meaningful in the context of the study. In most studies oriented towards science and the creation of public knowledge, the elements deal with the issue (sleeplessness), the emotions, how the product works, and so forth. The elements describe the ‘how’ and the ‘what.’

We face different issues in studies oriented towards sales and other commercial applications. First of all, the elements change, moving beyond knowledge to motivation. The focus turns to what convinces the customer to buy, with the ‘what’ ranging from name to benefit, and also to price. Typically, scientists are not interested in ‘brand names,’ nor are they particularly interested in item price, unless the price has something about it that makes it interesting from an economics points of view.

We see the elements for the Sleep Aid in Table 1. The table shows six different silos, each silo comprising six elements. The Sleep-Aid study was originally designed to identify the strongest selling messages. The messages include major brand (a must in selling), product name (also a must), as well as price (also necessary because price is important). The remaining three silos present different messages designed to communicate and to persuade.

| Silo A: Brand Name | |

| A1 | from Pure Chemistry |

| A2 | from Nature’s Pioneer |

| A3 | from Super Ecology |

| A4 | from Nature’s IQ |

| A5 | from Beyond Eden |

| A6 | from TranZEN |

| Silo B: Product Name | |

| B1 | Sleep Diet |

| B2 | Dream Shape |

| B3 | 8 Hour Solution |

| B4 | Zz Shots |

| B5 | Night Cap |

| B6 | Slim-Z |

| Silo C: General Benefit | |

| C1 | Do you want to lose weight, but hate dieting |

| C2 | Complete weight loss and sleep aid program in 1 convenient supplement |

| C3 | Achieve healthy weight & balanced metabolism |

| C4 | Money back guarantee |

| C5 | Weight loss benefits |

| C6 | Increase metabolism and speed fat oxidation |

| Silo D: Sleep benefit | |

| D1 | Sleep better tonight, live better tomorrow |

| D2 | Stop struggling, start sleeping |

| D3 | Fall asleep faster, stay asleep longer |

| D4 | Promotes deep and restful sleep |

| D5 | Helps support a restful night |

| D6 | Supports healthy sleep patterns |

| Silo E: Additional benefit | |

| E1 | Finally, comfortable in bed |

| E2 | Drug-Free Nighttime Sleep Aid |

| E3 | Powerful fat-fighting properties |

| E4 | Powerful fat-burning properties |

| E5 | Lose weight while you sleep |

| E6 | Anti-aging sleep and weight loss product |

| Silo F: Price | |

| F1 | $29.99 for a 1 month supply |

| F2 | $39.99 for a 1 month supply |

| F3 | $49.99 for a 1 month supply |

| F4 | $59.99 for a 1 month supply |

| F5 | $69.99 for a 1 month supply |

| F6 | $79.99 for a 1 month supply |

Table 1: The six silos and six elements for the Mind Genomics study on sleep aid.

Designing the test vignettes

Mind Genomics presents to the respondent different vignettes, combinations of elements, which create a ‘word picture.’ One might think of these vignettes in this particular study as small advertisements, albeit incomplete ones. Each vignette comprises three-four elements, a maximum of one element from each of the six silos. Every respondent evaluates 48 of these vignettes. Of these 48 vignettes or combinations, 36 comprise four elements, 12 comprise three elements. By design no vignette is complete, a property that will be important when it comes to statistical analysis by OLS, ordinary least-squares regression.

Mind Genomics presents to the respondent different vignettes, combinations of elements, which create a ‘word picture.’ One might think of these vignettes in this particular study as small advertisements, albeit incomplete ones. Each vignette comprises three-four elements, a maximum of one element from each of the six silos. Every respondent evaluates 48 of these vignettes. Of these 48 vignettes or combinations, 36 comprise four elements, 12 comprise three elements. By design no vignette is complete, a property that will be important when it comes to statistical analysis by OLS, ordinary least-squares regression.

Often times those who are new to the world of Mind Genomics in particular, and experimental design in general, feel that the combinations are created at random. The truth is just the opposite; the combinations are chosen with great care, so that each element is statistically independent of every other element (i.e., they act as independent agents), every element appears exactly five times, and finally the vignettes comprise exactly three or four elements.

Finally, Mind Genomics is designed so that each respondent evaluates a unique set of vignettes. Typical studies using experimental design create one basic set of combinations. Every respondent evaluates the same set of combinations. The researcher tries to minimize bias by rotating the order of appearance of the fixed set of vignettes. The Mind Genomics stratagem is more powerful; each respondent is exposed to the same elements, but the combinations differ. The structure remains the same, each element evaluated five times, each vignette comprising 3-4 elements, but the actual combinations or vignettes span a much wider range.

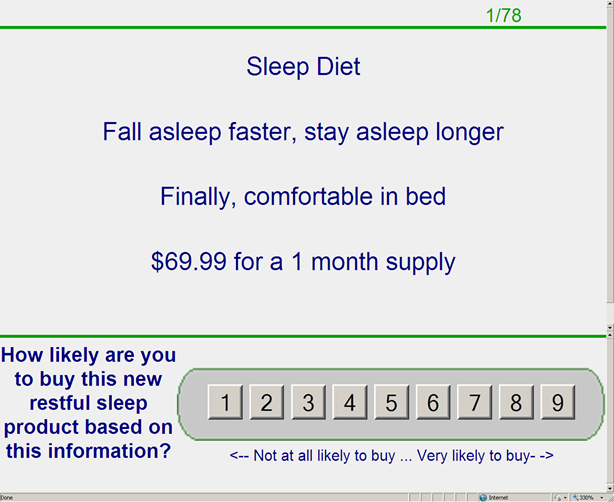

Figure 1 presents an example of a vignette. The elements appear centered in the vignette, in easy to read type, without any connectives. Only four of the six elements appear in the vignette. The layout makes the vignette easy to read. Purists might wish for all six elements, because they feel that respondents cannot make an informed decision without all the information. However, the reality is the opposite; making the vignette short, easy to read, and without connectives lets the respondent ‘graze’ the vignette, and then select the relevant information. Connectives between phrases make the respondent’s task more difficult.

At the bottom of the vignette we see the rating scale laid out for the first rating. The respondent simply presses the rating button, showing numbers 1-9, the computer records the selection, removes the rating scale, and presents the second rating scale. That rating scale, shown in Figure 2 requires that the respondent select the single feeling/emotion he has when reading the vignette. The second rating scale is really a selection, rather than a scale.

At the top right we see the two numbers 1/78. This third portion is the progression bar. It tells the respondent that we’re on the first vignette (screen), and that there will be a total of 78 such screens. Most respondents don’t really care how much they have to do, unless they have a limited amount of time, and have somewhere to go. The information lets the respondent track his progress, but eventually the focus on how much of the task has been done or is left recedes into the background as the respondent goes about the task.

Running the Mind Genomics study

The respondents in a Mind Genomics study are recruited by a third party, specializing in internet-based studies. The company providing the respondents creates the panel by inviting respondents to join, and finds out key demographic information (age, gender, income, market, ethnicity, etc.) Often these companies have panels comprising several million respondents, who at the time of becoming members of the panel, agree to participate by completing a form. This structure is called an ‘opt-in.’ Current practice in the world of consumer research is to have the respondent complete this form twice, to ensure that the respondent ‘knows’ what panel membership entails.

The respondents in a Mind Genomics study are recruited by a third party, specializing in internet-based studies. The company providing the respondents creates the panel by inviting respondents to join, and finds out key demographic information (age, gender, income, market, ethnicity, etc.) Often these companies have panels comprising several million respondents, who at the time of becoming members of the panel, agree to participate by completing a form. This structure is called an ‘opt-in.’ Current practice in the world of consumer research is to have the respondent complete this form twice, to ensure that the respondent ‘knows’ what panel membership entails.

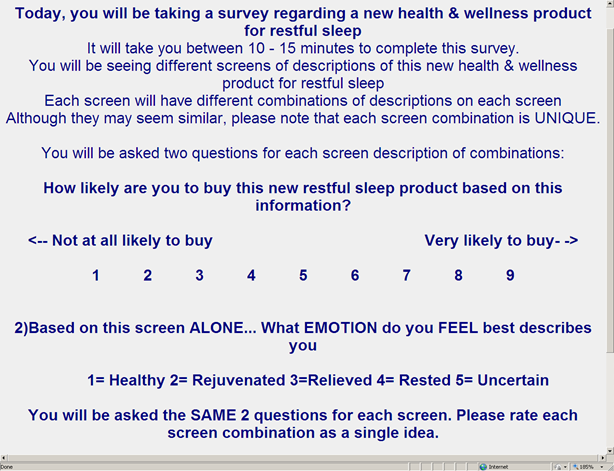

Respondents received an email invitation, with a link to the study embedded in the invitation. The respondent had to click on the embedded link or copy it, pasting it to the browser. The respondent then entered the study, and was greeted with the orientation page, shown in Figure 2. The orientation page provides the respondent with a little background information, not enough to bias, and then some additional information about the study.

In many of these Mind Genomics studies the respondents often ‘complain’ that they have seen the vignette previously, among the vignettes that they have rated already. They can make this mistake, false recognition, because the same element appears five times across 48 vignettes. With so many vignettes, and with the elements repeating in apparent random fashion, often the respondents complain that they have seen the stimulus before, whether it be the exact vignette, or simply parts of the vignette. Telling the respondents that each screen is unique helps to allay this concern by the respondent that he is not doing the study properly.

Who participated

The success of Mind Genomics depends both upon the elements selected for the topic and upon the appropriate respondents who participate in the study. For this study on Sleep-Aids it wasn’t clear whether the respondents should be purchasers of products, possible purchasers of products, or just the typical respondent. Often the focus of the research is so specific that a target group is called for; e.g., those who suffer from sleep problems and express a willingness to purchase Sleep-Aids ‘over the counter,’ e.g., in a vitamin store, etc.

The success of Mind Genomics depends both upon the elements selected for the topic and upon the appropriate respondents who participate in the study. For this study on Sleep-Aids it wasn’t clear whether the respondents should be purchasers of products, possible purchasers of products, or just the typical respondent. Often the focus of the research is so specific that a target group is called for; e.g., those who suffer from sleep problems and express a willingness to purchase Sleep-Aids ‘over the counter,’ e.g., in a vitamin store, etc.

For this study on Sleep-Aids, we made the decision to use the general population, with a reasonable number of respondents (here 301). Sleep problems are so pervasive that a study with the general population is likely to include a fair number of people who define themselves as having problems with sleeping. Table 2 shows how the respondents described who they were, and their sleep problems, if any Table 2 corroborates this widespread problem with sleep, and the reasonableness of recruiting respondents from the general population

| 6. Please indicate your GENDER: | |

| 7. Please indicate the AGE GROUP you belong to: | |

| 8. For demographic purposes only, which of the following BEST describes your ETHNIC background? | |

| 9. Which of the following best describes the neighborhood where you live? | |

| 10. Which of the following BEST describes the highest level of education you have completed? | |

| 11. What is your household income per year BEFORE TAXES? | |

| 12. How many children currently live in your household? | |

| 13. Please indicate your current MARITAL status. | |

| 14. On average, how many hours of sleep do you get each night? | |

| Less than 5 hours per night | 18 |

| 6-7 hours per night | 62 |

| 8 or more hours | 20 |

| 15. How easy is it for you to fall asleep? | |

| Difficult most nights | 28 |

| Average | 42 |

| Easy most nights | 30 |

| 16. How many over the counter medications or prescription drugs do you take for sleep? | |

| 2 or more different products most nights | 4 |

| 1 product most nights | 20 |

| Normally no products | 76 |

| 17. Do you use alcohol to help you fall asleep? | |

| Often | 1 |

| Sometimes | 19 |

| Never | 80 |

| 18. In general, do you get less than enough, adequate or more than enough sleep? | |

| Less than enough sleep most nights | 45 |

| Adequate amount of sleep most nights | 50 |

| More than enough sleep most nights | 5 |

Table 2: Results from the classification questionnaire (questions 6-13 deal with ‘who’ the respondent is; questions 14-18 deal with the respondent’s self-profiling of sleep problems, if any).

Macro analyses – are people even interested in these products?

The commercial nature of the topic, the performance of selling messages for a sleep-aid product, focuses us on the first question that should be answered. The question is really quite simple; does anyone really care about the product, based on the messages? Our respondents used a 9-point scale in Question #1 to tell us how interested they were in the product, or more specifically their likelihood of being interested in buying this ‘restful sleep product.’ We have 14,448 vignettes in the data base, each vignette having been rated by one of the respondents, both on purchase likelihood (rating Question #1) and on feeling/emotion (rating Question #2).

The commercial nature of the topic, the performance of selling messages for a sleep-aid product, focuses us on the first question that should be answered. The question is really quite simple; does anyone really care about the product, based on the messages? Our respondents used a 9-point scale in Question #1 to tell us how interested they were in the product, or more specifically their likelihood of being interested in buying this ‘restful sleep product.’ We have 14,448 vignettes in the data base, each vignette having been rated by one of the respondents, both on purchase likelihood (rating Question #1) and on feeling/emotion (rating Question #2).

Some of the answer comes from Table 3, which shows the distribution of the ratings for interest, and the distribution of the selections for feeling/emotion. The interest in buying was expressed on a 9-point Purchase Intent scale. To see the pattern more easily requires us to reduce some of the granularity. This reduction can be accomplished by dividing the Purchase Intent scale into three regions, 1-3, 4-6, and 7-9, respectively, rather than the more granular 1-9 scale. The table shows us that:

- The general interest in the Sleep-Aid is fairly low, based upon the distribution of ratings for purchase, Question #1. Most of the vignettes were assigned ratings of 1-3 on the 9-point scale, then ratings of 4-6. About one of seven vignettes was assigned a rating of 7-9.

- The data from the 14,000+ vignettes gives us a sense of how feelings/emotions may associate with evaluation or choice. Our analysis of the co-variation is called R-R, response-response. We are looking at two separate responses to the same stimulus, in order to discovery whether and then how they co-vary.

- For those vignettes which are least interesting, rated 1-3, the dominant feeling/emotion is ‘uncertain,’ (65%).

- For those vignettes which are moderately interesting, rated 4-6, the dominant feelings/emotions are uncertain, relieved, and then rested, respectively

- For those vignettes that are the most interesting, rated 7-9, the dominant feeling is rested

- It is clear, therefore, that there is a co-variation between interest in buying (the first question), and the feeling/emotion, but the relation is not a very strong one.

| Interest in buying | |||||

| Low (1-3) | Medium (4-6) | High (7-9) | Total | No. of Vignettes | |

| Feeling/emotion | |||||

| Uncertain | 65 | 29 | 11 | 49 | 7090 |

| Relieved | 6 | 28 | 19 | 13 | 1890 |

| Rejuvenated | 5 | 14 | 19 | 9 | 1371 |

| Healthy | 14 | 7 | 20 | 13 | 1922 |

| Rested | 9 | 22 | 30 | 15 | 2175 |

| Total | 100 | 100 | 100 | 100 | |

| No. of vignettes | 9039 | 3314 | 2095 | ||

Table 3: Distribution of ratings for interest in buying (question 1, columns) and feelings/emotions (question 2, rows).

How elements ‘drive’ responses – the power of experimental design

In this study as in the other Mind Genomics studies, the key to understanding the impact of the elements is to combine them into vignettes, present the vignettes to respondents, acquire ratings from the respondents to reflect how the respondents feel, and then deconstruct the ratings into the contributions of the different elements.

In this study as in the other Mind Genomics studies, the key to understanding the impact of the elements is to combine them into vignettes, present the vignettes to respondents, acquire ratings from the respondents to reflect how the respondents feel, and then deconstruct the ratings into the contributions of the different elements.

At first blush this approach seems to be a bit awkward and certainly labor-intensive for those who must do it manually. Why then do it? The answer is that when a respondent evaluates single elements, the respondent is dealing with an ambiguous situation. It’s not clear what the product is when the product has only a name or only a price. Mix up name, price, benefit into packages, test those among consumers, and its likely to end up with better data because the combination of elements is far less ambiguous than is the single element, on element at a time. Furthermore, when the respondent is faced with a ‘blooming, buzzing confusion’ (in William James’ terms, describing what the world must look like to a baby), it’s more likely that the respondent will maintain a fixed criterion, rather than changing the criterion to fit the nature of each new type of element (e.g., brand name vs benefit versus price). In short, vignettes work better than single elements because vignettes more clearly represent a description of a product.

What an experimentally designed vignette looks like

Mind Genomics uses experimental design to create the vignettes. The vignettes are created according to a master structure which ensures that the elements appear equally often, that the elements are statistically independent of each other, and that the data from each individual can be analyzed, person by person, using OLS (ordinary least-squares) regression.

Mind Genomics uses experimental design to create the vignettes. The vignettes are created according to a master structure which ensures that the elements appear equally often, that the elements are statistically independent of each other, and that the data from each individual can be analyzed, person by person, using OLS (ordinary least-squares) regression.

The structure for four vignettes appears in Table 4, in two sets of columns.

- Section A: On the left we see the six silos, A-F. Each vignette has at most one element from a silo, but often no elements from a silo. The experimental design takes care of which elements appear in which vignette. For example, vignette #1 has no elements from Silos A, B and E. Vignette #1 shows element C3, D6 and F6.

- Section B: This section shows the rating as assigned by the respondent. Q1, question 1, was the 9-point rating. For the four vignettes the respondent rated the first ‘2,’ the second ‘3,’ and so forth. The 9-point rating was also converted to a binary scale, to generate the ‘Interest Model.’ Ratings of 1-6 were converted to 0; ratings of 7-9 were converted to 100. Finally, the table shows the feeling/emotion selected for each vignette, and the creation of five new ‘dummy variables.’ Each feeling/emotion has its own dummy variable, which takes the value ‘0’ when the feeling/emotion was not selected, and takes the value ‘100’ when the feeling/emotion was selected.

- Section C shows a binary expansion of each vignette. There are 36 new binary or dummy variables, since each silo comprises six elements. Table 4 shows the first three of six elements for each silo. In Section C, each element becomes its own new variable. When a particular vignette contained an element, e.g., Vignette 3 containing A1, the variable A1 becomes ‘1’ for Vignette 3. In this way the experimental design allows us to transform each vignette to a mathematical structure of 0’s and 1’s for later use in regression analysis.

| Section A – Elements from the silo | Vig1 | Vig2 | Vig3 | Vig4 | Section C – Binary expansion | Vig1 | Vig2 | Vig3 | Vig4 |

| A1 | 0 | 0 | 1 | 0 | |||||

| Silo A | ABS | 4 | 1 | 3 | A2 | 0 | 0 | 0 | 0 |

| Silo B | ABS | ABS | 3 | 1 | A3 | 0 | 0 | 0 | 1 |

| Silo C | 3 | 1 | 5 | 6 | A4 | 0 | 1 | 0 | 0 |

| Silo D | 6 | 1 | ABS | ABS | A5 | 0 | 0 | 0 | 0 |

| Silo E | ABS | 5 | 3 | 1 | A6 | 0 | 0 | 0 | 0 |

| Silo F | 6 | ABS | 1 | 6 | B1 | 0 | 0 | 0 | 1 |

| B2 | 0 | 0 | 0 | 0 | |||||

| Section B – Ratings assigned by respondent | B3 | 0 | 0 | 1 | 0 | ||||

| Q1 BUY 9-point | 2 | 3 | 2 | 7 | B 4 | 0 | 0 | 0 | 0 |

| Q1 BINARY (Buy) | 0 | 0 | 0 | 100 | B5 | 0 | 0 | 0 | 0 |

| Q2 EMOTION | 4 | 5 | 4 | 3 | B6 | 0 | 0 | 0 | 0 |

| 1=Healthy | 0 | 0 | 0 | 0 | C1 | 0 | 1 | 0 | 0 |

| 2=Rejuvenated | 0 | 0 | 0 | 0 | C2 | 0 | 0 | 0 | 0 |

| 3=Relieved | 0 | 0 | 0 | 100 | C3 | 1 | 0 | 0 | 0 |

| 4=Rested | 100 | 0 | 100 | 0 | C4 | 0 | 0 | 0 | 0 |

| 5=Uncertain | 0 | 100 | 0 | 0 | C5 | 0 | 0 | 1 | 0 |

| C6 | 0 | 0 | 0 | 1 |

Table 4: Layout of the data, showing how the experimental design is first represented by ‘what is present’ in the vignette, and then transformed into a ‘dummy variable’ format appropriate for statistical analysis. It will be data structures of this type, the dummy variable format, that Mind Genomics will use for its statistical analyses, primarily employing OLS (ordinary least-squares) regression.

Creating the model using OLS (ordinary least squares) regression

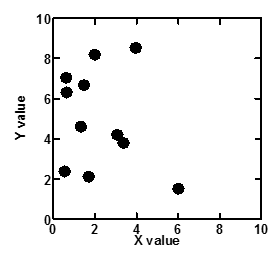

OLS regression, also known colloquially as curve fitting, comprises a class of statistical procedures which relate independent variables to a dependent variable. The most common form of OLS regression fits a straight line to data. We begin with a scatterplot, with the X axis or abscissa representing the independent variable, and the Y axis or ordinate representing the dependent variable. The data points are little filled circles in this scatterplot. Figure 3 shows an example of a scatterplot.

OLS regression, also known colloquially as curve fitting, comprises a class of statistical procedures which relate independent variables to a dependent variable. The most common form of OLS regression fits a straight line to data. We begin with a scatterplot, with the X axis or abscissa representing the independent variable, and the Y axis or ordinate representing the dependent variable. The data points are little filled circles in this scatterplot. Figure 3 shows an example of a scatterplot.

Figure 3: A typical scatterplot showing how two variable co-vary or change

with each other. Each filled circle corresponds to an observation. OLS regression

shows the relation between the dependent and the independent variable.

Now that we have plotted the data, we want to learn more about the relation between our two variables, X and Y. We begin by ‘assuming’ that the relation can be described by an equation. We use the term ‘assume’ because in truth we don’t know the ‘real’ relation between the variable plotted on the Y axis and the variable plotted on the X axis. We just know that each observation or case has an X value and a Y value.

The simplest assumption for Figure 3 is a straight line. We write the equation for a straight line as: Y = k0 + k1 (X).

The foregoing equation says simply that Y is the sum of a constant, k0, (the additive constant) and a weighted value of X. It is the goal of OLS regression to estimate the values k0 and k1, given the data. From that knowledge, researchers move further into the problem, looking at the possible interpretation to be given when discussing the empirical value of the additive constant, k0, and the weighting factor, k1.

Applying the OLS approach to experimental design

Let’s move from the hypothetical example in Figure 3 to the actual data that Mind Genomics generates. Table 4 shows us the information that is available to us.

Let’s move from the hypothetical example in Figure 3 to the actual data that Mind Genomics generates. Table 4 shows us the information that is available to us.

- Section C shows us that we can represent each vignette as a set of 0’s and 1’s, 0 to represent the fact that the element is missing from the vignette, and 1 to represent the fact that the element is present in the vignette. We expect each vignette to generate 36 columns, with 32-33 of the 36 columns having 0’s because most of the elements are missing. Three or four of the columns will have the value 1; these columns correspond to the elements that appear in the vignette.

- Section B shows us the dependent variable. The dependent variable for Question #1 can either be the 9-point rating of willingness to buy, or the binary transformation of that 9-point rating.

- When we work with the 9-point rating as the dependent variable, the model is known as the Persuasion Model. We write the Persuasion Model as: Rating = k0 + k1(Element A1). k36(Element F6). The additive constant, k0, tells us how many rating points on the 9-point scale we expect for a vignette with no elements. The coefficients or impact values, k1–k36, tell us how many rating points are added to the additive constant, k0, when the element is introduced into the vignette. We will use the Persuasion Model when we segment our respondents into groups based upon what elements the group considers to be important.

- When we work with the binary transformation as the dependent variable, the model is known as the Interest Model. We write the model in virtually the same way: Binary Rating (0/100) = k0 + K1(Element A1) …k36 (Element F6). The additive constant, k0, now tells us the percent of respondents who would rate a vignette 7-9 in the absence of elements. The additive constant is a purely estimated parameter. The coefficients or impact values, k1–k36, tell us the percent of respondents who would switch their rating from 1-6 (low on purchase) to 7-9 (high on purchase), when the element is incorporated into the vignette.

- For both the Persuasion and the Interest Models we construct a vignette by putting together elements from different silos, making sure not to have more than one element for a silo, and making sure to limit our vignettes to 3-4 elements.

- The experimental design allows us to estimate the parameters of the Persuasion Model and the parameters of the Interest Model at the level of the individual respondent. Unless stated otherwise, all data mentioned in this paper come from the average Interest Model across all the relevant respondents.

- In some cases, we will create on ‘grand’ model, incorporating all of the vignettes as cases, and the elements as predictors. We can create the grand model as well, because each respondent evaluates elements which are statistically independent of each other, and each respondent evaluates a permutation of the basic experimental design (Moskowitz., et al. 2013). The permutation allows the researcher to combine different experimental designs, one per respondent, and feel comfortable that in the final ‘grand design’ the elements are still statistically independent of each other.

What the Interest Model tells us

After all is done, just what convinces respondents to buy a Sleep-Aid? In most of the Mind Genomics studies in the Mind Genomics series we deal with topics that are intrinsically relevant to people, whether this be vacations, foods, medical care for oneself or one’s animal, and so forth. When we deal with Sleep-Aids, especially over the counter products, often products sold at the counter in C stores and in airports, we are entering into a new domain. We are entering into a world of products that are purchased to solve a product, but a world of products that are often purchased on impulse.

After all is done, just what convinces respondents to buy a Sleep-Aid? In most of the Mind Genomics studies in the Mind Genomics series we deal with topics that are intrinsically relevant to people, whether this be vacations, foods, medical care for oneself or one’s animal, and so forth. When we deal with Sleep-Aids, especially over the counter products, often products sold at the counter in C stores and in airports, we are entering into a new domain. We are entering into a world of products that are purchased to solve a product, but a world of products that are often purchased on impulse.

Let’s look at what our data tell us about the latter type of product, a Sleep-Aid that could be sold on the Internet, that might be purchased at a C-store. What do the results of our study tell us about the response to the product in a Mind Genomics study? Table 5 has some of the answers, at least for the total panel. We will look at the key findings, just listing them by number to get a sense of what’s happening.

Note: In a Mind Genomics study we do not try to support or to falsify a hypothesis. Mind Genomics isn’t about hypotheses about how the world works. Mind Genomics is rather about the picture painted by the elements. Each element contributes something in terms of driving a person to buy, or links with an emotion or feeling. When we have a lot of these pieces, what then is the picture that we think is being painted for us about the product or service we’re studying, here Sleep-Aid?

Here then are the key findings from the total panel, as shown by Table 5, and the rationales behind these findings.

- The additive constant for the Interest Model is very low, 11. As a point of comparison, the additive constant for many foods start at around 30, and often go to 50 or more. The additive constant 11 means that only 11% of the respondents are prepared to rate a Sleep-Aid product 7-9 on the 9-point scale, even without seeing the elements. The 11, very low, suggests that the basic idea is not particularly interesting. If the concept is going to perform well, it will be the elements that will do the work of convincing.

- When we look at the non-price elements, ranking the 30 elements in Silos A-E. from high to low in terms of impact value on the Interest Model we go from a high of +7 (stop struggling, start sleeping) to a low of -1 (Weight loss benefits). Clearly the elements are not motivating, at least to the total panel.

- Increasing price (bottom of Table 5) decreases interest in buying the Sleep-Aid.

- Looking at all 301 respondents reveals that there is no ‘magic bullet,’ no element which is common to the different products, and which scores quite well

| Total sample – sleep aid project. Base size = 301 respondents | Total Sample |

| Additive Constant | 11 |

| Stop struggling, start sleeping | 7 |

| Fall asleep faster, stay asleep longer | 5 |

| Drug-Free Nighttime Sleep Aid | 4 |

| Sleep better tonight, live better tomorrow | 4 |

| Helps support a restful night | 4 |

| Promotes deep and restful sleep | 3 |

| Complete weight loss and sleep aid program in 1 convenient supplement | 3 |

| Supports healthy sleep patterns | 3 |

| from Nature’s Pioneer | 3 |

| Achieve healthy weight & balanced metabolism | 3 |

| Increase metabolism and speed fat oxidation | 3 |

| Money back guarantee | 2 |

| Anti-aging sleep and weight loss product | 2 |

| Do you want to lose weight, but hate dieting | 2 |

| from Nature’s IQ | 2 |

| from Super Ecology | 2 |

| Dream Shape | 2 |

| 8 Hour Solution | 1 |

| Slim-Z | 1 |

| Powerful fat-fighting properties | 0 |

| Lose weight while you sleep | 0 |

| from TranZEN | 0 |

| from Pure Chemistry | 0 |

| Sleep Diet | 0 |

| Finally, comfortable in bed | 0 |

| from Beyond Eden | 0 |

| Zz Shots | 0 |

| Night Cap | 0 |

| Powerful fat-burning properties | 0 |

| Weight loss benefits | -1 |

| $29.99 for a 1 month supply | 4 |

| $39.99 for a 1 month supply | -3 |

| $49.99 for a 1 month supply | -3 |

| $59.99 for a 1 month supply | -6 |

| $69.99 for a 1 month supply | -7 |

| $79.99 for a 1 month supply | -7 |

Table 5: Performance of the 36 elements for sleep aid, based on the Interest Model. The first part of the table shows the impact values for the non-price elements. The price elements appear at the bottom of Table 5.

Maybe it’s gender - males versus females

Often researchers ‘look for’ variation, generally in the stimuli that they use for evaluation, but also variation among groups, e.g., gender. There’s no reason to assume that in the case of Sleep-Aids there would be any effect of gender. Table 6 shows that there is virtually no difference between the responses of males and females to the Sleep-Aid, either at the level of the additive constant (10 for males, 11 for females), or at the level of the element.

Often researchers ‘look for’ variation, generally in the stimuli that they use for evaluation, but also variation among groups, e.g., gender. There’s no reason to assume that in the case of Sleep-Aids there would be any effect of gender. Table 6 shows that there is virtually no difference between the responses of males and females to the Sleep-Aid, either at the level of the additive constant (10 for males, 11 for females), or at the level of the element.

| Tot | Male | Fem | |

| Base size | 301 | 100 | 201 |

| Additive constant | 11 | 10 | 11 |

| Stop struggling, start sleeping | 7 | 8 | 6 |

| Fall asleep faster, stay asleep longer | 5 | 5 | 4 |

| Finally, comfortable in bed | 0 | 5 | -2 |

| $79.99 for a 1 month supply | -7 | -5 | -8 |

Table 6: The elements for sleep aid showing the greatest gender difference (male vs female). The elements for sleep aid showing the greatest effects for three groups, based on how easy the respondents in each group say it is for them to go to sleep.

What about people having a difficult time falling asleep

It stands to reason that people who say that they have a difficult time falling asleep should be more interested in a Sleep-Aid than people who say that they have no trouble, that most nights they it easy to fall asleep. In the self-profiling classification, respondents described themselves in terms of such difficulty. Mind Genomics allows us to average the individual-level models for those in each of the three self-defined groups (Table 7). The results tell this story:

It stands to reason that people who say that they have a difficult time falling asleep should be more interested in a Sleep-Aid than people who say that they have no trouble, that most nights they it easy to fall asleep. In the self-profiling classification, respondents described themselves in terms of such difficulty. Mind Genomics allows us to average the individual-level models for those in each of the three self-defined groups (Table 7). The results tell this story:

- It is clear that those who say that they have a difficult time falling asleep (85 of the 301 respondents, almost one out of three) are most interested in this product, even without elements. Their additive constant is 21. In contrast, those who say that they experience average difficulty or those who say that they find it easy to fall asleep are basically uninterested. Their additive constants are 9 and 4, virtually 0. Keep in mind that the additive constant is an estimated parameter; we did not ask their basic interest in the product, but rather estimate that interest from the pattern of ratings, and how much of the pattern can be attributed to the specific elements.

- When we deal with elements another part of the story emerges, a surprise.

- Those who say it is difficult to fall asleep respond to the messages about better sleeping and restful nights. This group is ‘turned off’ by the price.

- Those who say it is neither difficult nor easy, those who feel that they have an average time falling asleep, want to know that they can sleep, and are turned off by the highest price, but not as turned off as those who say that they find it difficult to fall asleep. Perhaps to the ‘average’ group, price is less relevant because they’re basically not interested in the product.

- Those who say that it is easy to fall asleep want to know that the product works, and do not respondent particularly negatively to the high prices, perhaps because once again they are not going to buy the product anyway. The lack of interest applies to the high price; they’re not going to buy, so the price statement is just a phrase, not something that they would consider.

| Difficult most nights | Average | Easy most nights | |

| Base size | 85 | 126 | 90 |

| Additive constant | 21 | 9 | 4 |

| Difficult most nights | |||

| Sleep better tonight, live better tomorrow | 9 | 2 | 3 |

| Helps support a restful night | 7 | 4 | 1 |

| $79.99 for a 1 month supply | -11 | -8 | -1 |

| $59.99 for a 1 month supply | -14 | -2 | -3 |

| $69.99 for a 1 month supply | -14 | -3 | -5 |

| Average | |||

| Stop struggling, start sleeping | 6 | 7 | 8 |

| $79.99 for a 1 month supply | -11 | -8 | -1 |

| Easy most nights | |||

| Supports healthy sleep patterns | 2 | 1 | 8 |

| Stop struggling, start sleeping | 6 | 7 | 8 |

Table 7: The elements for sleep aid showing the greatest effects for two mind-set segments (columns B1-B2) and for three mind-set segments (columns C1-C3). The three-segmentation solution shows the greatest promise.

Mind-set segments

At the very core of Mind Genomics lies the recognition that people differ from each other in the strength of their reaction to external stimuli, and that the pattern of different reactions suggest underlying groups. These groups, mind-sets in Mind Genomics language, differ by the pattern of their responses to the test stimuli. These test stimuli focus on a limited but exceptionally RELEVANT aspects of the every-day, quotidian, humdrum life of ordinary people. That is, the segmentation performed by Mind Genomics, clusters people into relevant group based on differences into responses to relevant messages about the behavior being studied. In our Sleep-Aid study, that behavior is response to messages about a Sleep-Aid product.

At the very core of Mind Genomics lies the recognition that people differ from each other in the strength of their reaction to external stimuli, and that the pattern of different reactions suggest underlying groups. These groups, mind-sets in Mind Genomics language, differ by the pattern of their responses to the test stimuli. These test stimuli focus on a limited but exceptionally RELEVANT aspects of the every-day, quotidian, humdrum life of ordinary people. That is, the segmentation performed by Mind Genomics, clusters people into relevant group based on differences into responses to relevant messages about the behavior being studied. In our Sleep-Aid study, that behavior is response to messages about a Sleep-Aid product.

We create these mind-set segments by statistical methods, and then try to interpret them. Segmentation in Mind Genomics is driven by strict empirical methods, rather than by an a priori theory of ‘how the world works.’ In fact, even if we had a general theory of the way the word of health products work, we would not necessarily be able to apply that general theory to Sleep-Aids. We have to segments based upon the Sleep-Aid data, and nothing else at all.

The statistics for the segmentation come from standard clustering procedures. Clustering, dividing a set of objects into complementary groups, the segments, uses mathematical criteria for establishing these groups. Typically, the groups should be ‘compact.’ They should cluster around a central core, so that the individual members of the group are similar to the core. And, the groups should different from each other; the profiles of the ‘cores’ of each segment have to be fairly different from each other. These first two criteria, compactness of a segment, and differences between the core or centroid of complementary segments, are defined by strict mathematical criteria.

The third criterion for segmentation is interpreting the segments, more of an art than a science. Just because the computer can divide the respondents into mathematically homogeneous groups based upon a set of criteria does not mean that the division is meaningful. We ‘name’ the segments by looking at the strongest performing elements. These elements are the ones with the highest impact values or coefficients in the Interest Model.

To get a sense of how one goes about choosing a reasonable segmentation, consider the results in Table 8. The 301 respondents were divided into two segments, and then the 301 respondents were then again divided into three segments, instead of into two segments. There are many different methods by which to divide respondents. Clustering programs use different methods, and different criteria; those don’t concern us now. All that we want to focus on is the interpretation of the segments, and the selection of the ‘better’ solution.

We begin with the two Segment solution (columns marked B1 and B2, respectively).

- The segmentation program divided our 301 respondents into two very unequally sized groups, one with 260 respondents, the other with 41 respondents. The division into such unequal groups is rare when we deal with general topics like vacations, jewelry, credit cards, and so forth, often because the elements in those studies have greater ‘richness’ of meaning. For our Sleep-Aid study, the elements are straightforward ‘selling messages,’ often with far less richness of meaning.

- Both segments show low additive constants, 11 for Segment 1 and 13 for Segment 2, respectively. The additive constant is a measure of the likelihood of saying ‘yes, I’d buy’ when the topic of Sleep-Aid is introduced, but there are no elements. The results suggest to us that neither segment is particularly interested. As yet we have no way of knowing how these segments differ from each other, which they do, at least in a statistical sense.

- Segment 1 of 2 (column B1) shows only one noteworthy element; stop struggling, start sleeping. This is a modest scoring element at best. Segment 1 is turned off by the high prices.

- Segment 2, with fewer respondents, doesn’t pay attention to price at all, but responds very strong to ‘fall asleep faster, stay asleep longer.’ We get a sense that Segment 2 may be more promising; they react to solid benefits. Segment 2 is turned off with the combination of weight loss and Sleep-Aid.

- The two segment solution divides respondents into different groups, but we’re left with a nagging feeling that in truth, there’s really nothing special here, nothing enlightening.

- We now move to the three-segment solution, where we see stronger differentiation. We should see this stronger differentiation because three segments allow us to identify three types of messages just not two. With three segments we don’t have to combine messages of different types because we simply have no room. Three segments give us more room to sort our messages.

- The information for three segments appears in columns C1-C3.

- The three-segment solution begins with one very large segment (n=242) and two smaller segments (n=34, n=25). Segments 2 and 3 begin with absolute disinterest (5 and 3, respectively); Segment 1 begins with low interest [12].

- The key results appear in the strong responses to elements shown by Segments 2 and 3. For these two segments, the key is the performance of the elements.

- Segment 2 responds primarily to lower prices and brand.

- Segment 3 responds virtually entirely to end-benefits of the product

It is clear from mind-set segmentation that a potentially richer understanding can be gained by dividing the respondents by the pattern of their responses. If we were to look only at the total panel, or only at the conventional subgroups defined by who the respondent is (gender), or by how the respondent defines himself (intensity of the sleep problem), we would never see any positive impact, on average, emerging from the pricing elements, or from the brand/name elements. The pricing elements would generally be negative, the brand/name elements would hover around 0 because these names do not correspond to existing, well known products. Yet, from the mind-set segmentation it becomes clear that we are dealing with two groups, each roughly 10% of the population, who can be persuaded to buy the product by proper messaging.

| A | B1 | B2 | C1 | C2 | C3 | |

| Tot | Seg1 of 2 | Seg 2 of 2 | Seg 1 of 3 | Seg 2 of 3 | Seg 3 of 3 | |

| Base Size | 301 | 260 | 41 | 242 | 34 | 25 |

| Constant | 11 | 11 | 13 | 13 | 5 | 3 |

|

||||||

Segment 1 of 2 |

||||||

| Stop struggling, start sleeping | 7 | 7 | 8 | 6 | 8 | 15 |

| $59.99 for a 1 month supply | -6 | -7 | 2 | -7 | 3 | 1 |

| $79.99 for a 1 month supply | -7 | -8 | 3 | -9 | 5 | 0 |

| $69.99 for a 1 month supply | -7 | -8 | 4 | -9 | 8 | -3 |

Segment 2 of 2 |

||||||

| Fall asleep faster, stay asleep longer | 5 | 3 | 13 | 3 | 8 | 12 |

| Do you want to lose weight, but hate dieting | 2 | 4 | -10 | 4 | -5 | -8 |

| Anti-aging sleep and weight loss product | 2 | 4 | -11 | 4 | -8 | -2 |

Segment 1 of 3 |

||||||

| Stop struggling, start sleeping | 7 | 7 | 8 | 6 | 8 | 15 |

| $69.99 for a 1 month supply | -7 | -8 | 4 | -9 | 8 | -3 |

| $79.99 for a 1 month supply | -7 | -8 | 3 | -9 | 5 | 0 |

Segment 2 of 3 – end benefit, brand and price |

||||||

| Finally, comfortable in bed | 0 | 2 | -8 | -2 | 20 | -6 |

| $49.99 for a 1 month supply | -3 | -4 | 4 | -6 | 17 | 5 |

| from TranZEN | 0 | -1 | 6 | -2 | 15 | 6 |

| $39.99 for a 1 month supply | -3 | -4 | 8 | -6 | 15 | 5 |

| from Nature’s Pioneer | 3 | 3 | 1 | 1 | 14 | 9 |

| from Nature’s IQ | 2 | 2 | 1 | 0 | 14 | 7 |

| $29.99 for a 1 month supply | 4 | 4 | 8 | 3 | 13 | 6 |

| from Pure Chemistry | 0 | 1 | -2 | -1 | 10 | -1 |

| Weight loss benefits | -1 | -1 | -1 | 1 | -10 | -1 |

| Achieve healthy weight & balanced metabolism | 3 | 3 | -2 | 5 | -11 | -3 |

Segment 3 of 3 – End benefit |

||||||

| Stop struggling, start sleeping | 7 | 7 | 8 | 6 | 8 | 15 |

| Supports healthy sleep patterns | 3 | 3 | 6 | 2 | 3 | 13 |

| Fall asleep faster, stay asleep longer | 5 | 3 | 13 | 3 | 8 | 12 |

| Promotes deep and restful sleep | 3 | 3 | 4 | 3 | 0 | 11 |

| Sleep better tonight, live better tomorrow | 4 | 4 | 7 | 4 | 2 | 10 |

| Slim-Z | 1 | 0 | 5 | 0 | -5 | 10 |

| 8 Hour Solution | 1 | 0 | 3 | 0 | -3 | 10 |

| Do you want to lose weight, but hate dieting | 2 | 4 | -10 | 4 | -5 | -8 |

Table 8: Strongest performing elements for Exercise Supplment product for males and females.

How pricing drives responses – a look across groups

Silo F comprised six prices. Each price appeared five times in the 48 vignettes rated by a respondent and was absent from the vignettes 43 times out the 48. The experimental design allows us to estimate the contribution of each price to an individual’s Interest Model for buying the Sleep-Aid product. As we move forward in our analysis of pricing, we should keep in mind that the Mind Genomics approach is essentially a ‘torture’ test. A respondent saw at most one price in a vignette, and each price was presented against different backgrounds. There is no reason to think that with this type of stimulus presentation, i.e., single price elements and ever-changing backgrounds, that we should see any logical pattern, unless the respondent is paying attention to price as part of the test stimulus, but not paying undue attention.

Silo F comprised six prices. Each price appeared five times in the 48 vignettes rated by a respondent and was absent from the vignettes 43 times out the 48. The experimental design allows us to estimate the contribution of each price to an individual’s Interest Model for buying the Sleep-Aid product. As we move forward in our analysis of pricing, we should keep in mind that the Mind Genomics approach is essentially a ‘torture’ test. A respondent saw at most one price in a vignette, and each price was presented against different backgrounds. There is no reason to think that with this type of stimulus presentation, i.e., single price elements and ever-changing backgrounds, that we should see any logical pattern, unless the respondent is paying attention to price as part of the test stimulus, but not paying undue attention.

Table 5 showed us that the respondents pick up the differences among the prices, with only the lowest price element ($29.99/month) adding any substantial value to the Interest Model. The other five price points diminished the impact. The negative impact numbers show us that these prices actually pulled away respondents from being interested and wanting to buy the Sleep-Aid.

In this section we look at the effect of price on the Interest Model for different groups, and specifically the search for different patterns of responses across the groups of respondents defined by gender, etc. Keep in mind that we are dealing with sales-oriented messages. Our question is whether any group responds strongly to price in the context of these messages. We are looking for exceptions to the pattern established by the ‘total’ panel.

When we began this paper, we adopted a simple strategy used to analyze data from studies using experimental design. We deconstructed the response to the vignettes, emerging with the additive constant, and with one number, the impact value, for each of the 36 elements. The deconstruction uses the pattern of responses to the 48 vignettes to produce a best estimate of the additive constant, and a best estimate of the impact value for each element.

Let us now recreate one-element vignettes, comprising one price, and one price only, without anything else in the vignette. We can create this vignette, or better we can estimate the value from the Interest Model, simply by combining the additive constant and the coefficient for that price as an element (also called the impact value.) The sum tells us the percent of respondents who would say that they’d ‘buy’ the Sleep-Aid, knowing only that it is a Sleep-Aid, and knowing only the price, nothing more.

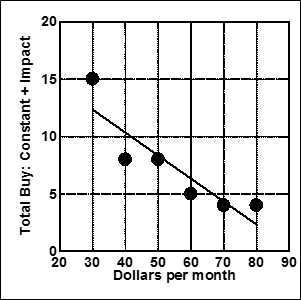

When we create the six estimated sums, one for each price, we end up adding the identical value (additive constant) to the unique value brought by the element. To get a sense of the relation between likelihood to purchase (ordinate in Figure 45) and the dollar value of one month of the Sleep-Aid (abscissa in Figure 5), we plot the data, the sum or ‘total buy’ versus the dollars per month. The data suggests a straight line with a negative slope, at least for the total panel:

Total Buy = additive constant + slope (dollars/month for the Sleep-Aid).

Figure 4 shows us the plotted relation, in a scatter gram. We try to put a straight line through the results. We will be interested in the slope of that straight line. The slope will tell us the sensitivity of the respondents in the group to unit increases in price.

Figure 4: Relation between increasing monthly price of the sleep aid

(from 29.99/month to 89.99/month) and the estimated likelihood to

buy (additive constant + impact value for the specific price).

‘Cognitive Economics’ - What the pricing data tell us about different subgroups

Mind Genomics lets us build the Interest Model for each person, on a person by person basis. In turn, each key subgroup comprises a specific group of respondents, defined either by who they are (e.g., gender, age, where they live, income), by what they say about themselves regarding sleeping problems, where they say they buy products, and how they respond to the elements (columns A and B in Table 9.) Table 9 shows us the data for each subgroup.

Mind Genomics lets us build the Interest Model for each person, on a person by person basis. In turn, each key subgroup comprises a specific group of respondents, defined either by who they are (e.g., gender, age, where they live, income), by what they say about themselves regarding sleeping problems, where they say they buy products, and how they respond to the elements (columns A and B in Table 9.) Table 9 shows us the data for each subgroup.

As we move through the data, we will two key numbers, the slope and the average rating across the six prices. Column C: Slope, or change in total interest per 1$ increase in monthly price of Sleep-Aid. This is the key column. The slope is negative meaning that dollar increases diminish interest in buying, as they should. For the total panel the slope is -0.20, meaning that every dollar increase in price drops the percent of people who say they will buy by -0.20 or one fifth of a percent.

- We expect the slope to be negative. That is, as the monthly price increases, we expect the total interest in buying to decrease. As noted above, even though the respondent never saw more than one price in a vignette, and even though the background against which the price element was embedded changed from vignette to vignette, we expect that the respondent would incorporate the price statement as part of the decision. We also expect that, perhaps unbeknownst to the respondent, there is a mental ‘rule’ that says that ‘higher price is less interesting.’ Our data allow us to uncover whether or not that rule applies to different groups, and the quantitative nature of that rule.

- Males and females show approximately the sensitivity to price

- Those under 40 are more price sensitive (slope = -0.18), those over 40 are less price sensitive (slope = -0.07)

- There is no consistent pattern of price sensitivity for respondents living in different places, such as rural versus city. Those who live in the suburbs and in a large city are most price sensitive.

- Those with middle income (40k – 75k) are more price sensitive than those with higher incomes or lower incomes, respectively.

- When it comes to having sleep problems, those who report that they don’t sleep enough show the highest negative slope (-0.26).

- Those who want to buy the product in capsule form show the highest price sensitivity

- The three mind-set segments show similar price sensitivities. Just because they differ in what drives their interest does not mean they are indifferent to price. They are more similar than they are different.

- The big surprise is network marketing – those who buy their products through network marketing find higher prices more interesting, more motivating, perhaps because they can get even higher prices when they sell the Sleep-Aid. This major exception to the demand curve makes a great deal of sense when we realize how these network marketing sales work.

- Those who report being concerned with sexual dysfunction are also the most price sensitive.

- The ‘bottom line’ for these results is that we see price sensitivity, but without a pattern. Furthermore, the anomalous results from those who buy from network marketers, and presumably sell to others, now makes sense.

Column D: Average total interest across the six prices. We already know how to compute the total interest in buying; combine the additive constant and the individual impact value for the price, both numbers taken from the Interest Model. We can create these six sums, one for each price point. The average gives us a sense of basic interest in the Sleep-Aid, when only price is known. The average for the total panel is 7.33, very low, because for the total panel price is generally negative, detracting from total interest in buying. Glancing down at the different averages in column D will show us a number of much higher averages.

- The total panel averages 7.33

- Younger respondents under 40 are more likely to say they will buy this Sleep-Aid than will older respondents over 40.

- Respondents in small and large cities will more likely buy

- Respondents with lower incomes will more likely buy

- Respondents who have NO problems sleeping will more likely buy (unexpected finding)

- Respondents who expect to mix the product in a beverage and then drink it will more likely buy

- Segment 2 (brand and price responsive) will more likely buy

- Those who buy health products through ‘network marketing’ will more likely buy

- Those who are concerned with depression and sexual dysfunction will more likely buy

| A | B | C | D |

| Group | Specific subgroup | Change in Total Interest per $ in monthly price of sleep aid (k1) | Average total interest across six prices |

| Total | Total panel | -0.20 | 7.33 |

| Who the respondent is | |||

| Gender | Male | -0.17 | 9.17 |

| Female | -0.21 | 7.17 | |

| Age | Under 40 | -0.18 | 13.50 |

| Over 40 | -0.07 | 1.33 | |

| Where live | Rural | -0.21 | 6.17 |

| Small town | -0.16 | -2.50 | |

| Suburb | -0.25 | 5.17 | |

| Small city | -0.11 | 10.67 | |

| Urban, large city | -0.19 | 14.67 | |

| Income | Income LT 40k | -0.14 | 11.17 |

| Income 40-70k | -0.27 | 6.17 | |

| Income 75k+ | -0.16 | 6.50 | |

| Sleep behavior and sleep products | |||

| Sleep Amt | Not enough sleep | -0.26 | 7.50 |

| Adequate sleep | -0.17 | 6.83 | |

| More than enough | -0.11 | 16.50 | |

| How used | Teaspoon in drink | -0.15 | 16.17 |

| Premixed | -0.18 | 6.33 | |

| Capsules (3) | -0.24 | 3.67 | |

| Where buy | Drug store | -0.23 | 11.67 |

| Health food store | -0.11 | 12.00 | |

| Supermarket | -0.19 | 7.50 | |

| Online | 0.09 | 16.33 | |

| Network marketing | 0.35 | 29.17 | |

| Don’t buy | -0.25 | 9.83 | |

| Concerns | Aging | -0.18 | 4.33 |

| Depression | -0.11 | 11.83 | |

| Sexual dysfunction | -0.34 | 23.33 | |

| Mind-set segments | |||

| Segment | Segment 1 | -0.20 | 7.00 |

| Segment 2 | -0.20 | 15.33 | |

| Segment 3 | -0.14 | 5.00 | |

Table 9: Parameters of the equation relating total interest to monthly dollar cost of the sleep aid. The equation is written as: Total Interest = k0 + k1(Monthly Dollar Cost). Column C shows the average total interest across the six prices. Column D shows the additive constant, k0. Column E shows the slope, k1. Column F shows the goodness-of-fit statistic.

Linking elements with feelings/emotions

Respondents selected one of five different feelings/emotions when they read a vignette, making their selection after they rated the vignette on likelihood to purchase. When we deal with feelings/emotions in Question #2 we move away from having the respondent scale the intensity of feelings and move towards the selection of a feeling from among a set.

Respondents selected one of five different feelings/emotions when they read a vignette, making their selection after they rated the vignette on likelihood to purchase. When we deal with feelings/emotions in Question #2 we move away from having the respondent scale the intensity of feelings and move towards the selection of a feeling from among a set.

We analyze the feeling/emotion data a bit differently, again using OLS (ordinary least-squares regression) to calculate the parameters. Yet, as we will see, some of the way we analyzed the purchase intent data from Question #1 will inform how we deal with feelings/emotions.

We begin with the nature of the data, which we see in Table 4. For each vignette a respondent evaluated we know the composition of that vignette, the elements from the set of 36 that were present, and of course the elements that we absent. We also know the feeling/emotion that was selected, and the complement, the four feelings/emotions that were not selected. Our first step in the analysis converts these data into a form that can be used by OLS regression to return meaningful results. It would be no exaggeration to say that most of the effort in analysis goes into structuring the data for statistics. The actual computation of summary statistics and regression models becomes a simple matter once the data is properly set up for analysis.

The analysis follows the next five steps. Each step defines a specific action. The rationale of the step is provided when relevant. Our objective is to prepare the data set for analysis at the individual respondent level, using OLS regression.

- Create five new variables, one variable for each of the five feelings/emotions. We create a new variable for ‘healthy,’ another for ‘rejuvenated,’ a third for ‘relieved,’ a fourth for ‘rested,’ and a fifth for ‘uncertain.’

- For each vignette code the selected feeling/emotion as ‘100’ and code the remaining four non-selected feelings/emotions as ‘0.’ Each vignette will end up with one, and only one feeling/emotion selected for it. That selected feeling/emotion will be coded as 100. For computation purposes add in a very small random number (~ 10-5) to the five values, which are either 0 or 100, respectively. The random number will not affect the results but will enable the OLS regression to ‘run’ without problems.

- Steps 1 and 2 created the data matrix that we need for the analysis. The 48 vignettes generate 48 rows of data, one row per vignette, with each row comprising five columns, one column for each feeling/emotion. The column either has a 0 or a 100, plus a small random number. Adjoin to that matrix the design matrix, also comprising 48 rows, one per vignette, and 36 columns, one column per element.

- Using OLS regression, relate the presence/absence of the 36 elements to each feeling/emotion, one feeling/emotion as the dependent for a regression. With five feelings/emotions, we end up with five OLS regressions. Run the regressions without the additive constant. The feeling/emotion model is expressed as: Rating = k1(A1) + k2(A2) ... k36(F6)

- The coefficients k1 ... k36 tell us the percent of times that the feeling/emotion can be linked with a specific element in a vignette of 3.75 elements. The calculation follows these steps:

- The vignette comprises 3.75 elements

- The total percent of time an emotion is selected is, by the task requirements, 100%

- Thus, in a vignette, each element is responsible for 100%/3.75 or 26.66% of the emotions. The sum of the five feelings/emotions for any element is always 26.66%.

- If the emotions are assigned at random, and if there are five such feelings/emotions, then we divide that 26.66% by 5 to end up with a value of 5.33 when the feelings/emotions are randomly assigned. That is, in the totally random case, with no real linkage between element and emotion, OLS regression would return with a coefficient of 5.33 for each feeling/emotion liking with each element.

- Therefore, when we see coefficients, not of 5.33, but of 10-11 or higher, we can feel comfortable that the linkage between the element and the feeling/emotion is not random.

Now that we know what we are looking for, consider the linkages between the five feelings/emotions and the elements. Table 10 presents the linkages.

- No elements link strongly with healthy, nor rejuvenated, or nor relieved, respectively. The linkages are at best minor, around 2-4.

- Only one element links with restful – ‘helps support a restful night.

- Most elements link with one feeling/emotion – uncertain. The strength of linkages varies. For example, ‘do you want to lose weight, but hate dieting’ links very strongly to uncertain, perhaps because the element is not relevant to Sleep-Aid.

- Most names link to uncertain

- The weight of the data suggests that when we position the elements for selling, and use brand and short tag lines for benefits, we end up with ‘uncertain’ as the feeling. This overwhelming selection of ‘uncertain’ makes sense; we are really NOT providing much educationally useful explanations in the vignettes. Rather, the vignettes are perceived as being designed for sales.

| Total Panel. 301 | Healthy | Rejuvenated | Relieved | Rested | Uncertain |

| Helps support a restful night | 2 | 3 | 4 | 11 | 6 |

| Do you want to lose weight, but hate dieting | 3 | 1 | 2 | 2 | 18 |

| Zz Shots | 2 | 3 | 2 | 3 | 17 |

| from TranZEN | 4 | 1 | 3 | 3 | 16 |

| from Super Ecology | 4 | 3 | 3 | 3 | 16 |

| from Nature's Pioneer | 4 | 2 | 2 | 3 | 16 |

| Sleep Diet | 1 | 4 | 4 | 4 | 15 |

| from Nature's IQ | 4 | 3 | 4 | 2 | 15 |

| Weight loss benefits | 2 | 2 | 3 | 3 | 14 |

| Night Cap | 3 | 3 | 2 | 4 | 14 |

| from Pure Chemistry | 7 | 2 | 4 | 2 | 14 |

| 8 Hour Solution | 1 | 4 | 4 | 3 | 13 |

| Powerful fat-fighting properties | 4 | 2 | 3 | 2 | 13 |

| Slim-Z | 1 | 3 | 5 | 4 | 13 |

| Increase metabolism and speed fat oxidation | 3 | 5 | 4 | 1 | 13 |

| Dream Shape | 3 | 1 | 6 | 4 | 13 |

| Money back guarantee | 4 | 1 | 5 | 4 | 13 |

| from Beyond Eden | 4 | 1 | 5 | 5 | 12 |

| Lose weight while you sleep | 4 | 0 | 4 | 6 | 12 |

| Anti-aging sleep and weight loss product | 4 | 3 | 3 | 4 | 12 |

| Powerful fat-burning properties | 8 | 2 | 3 | 3 | 11 |

| Supports healthy sleep patterns | 3 | 4 | 3 | 7 | 10 |

Table 10: Strong linkages (> 10) between elements and feelings/emotions. Random linkages would generate a linkage of 5.33. The table presents linkages of 10 or higher.

Ratings of likelihood to buy change with different feelings/emotions

We finish this paper by integrating emotions and interest, Question #2 and Question #1, respectively. In previous, unpublished studies by the author, it became increasingly clear that feelings/emotions changed across different vignettes, even for the same respondent. This change is no surprise. The nature of the vignettes is such that they should provoke different feelings/emotions, although which particulars ones and the connection to the elements is left to the respondent and to the particular topic.

We finish this paper by integrating emotions and interest, Question #2 and Question #1, respectively. In previous, unpublished studies by the author, it became increasingly clear that feelings/emotions changed across different vignettes, even for the same respondent. This change is no surprise. The nature of the vignettes is such that they should provoke different feelings/emotions, although which particulars ones and the connection to the elements is left to the respondent and to the particular topic.

A more general question, however, keeps emerging: Can we link the feelings/emotions to the responses? At the very gross level we see a relation, as Table 8 shows us. We divide the responses to Question #1 into three groups, ‘low’ (ratings 1-3), ‘medium’ (ratings 4-6), and ‘high’ (ratings 7-9). We do this to make the analysis easier. Too much graininess in the data, too much detail, often cloaks the pattern as often it illuminates it.

After dividing the ratings into three groups we look at the pattern of responses to the vignettes for each of the five feeling/emotion states. That is, when the respondent said he felt ‘uncertain,’ how did this affect his ratings? Table 8 shows us that when the respondent felt ‘uncertain’ 83% of the ratings were ‘low,’ 1-3, and 96% of the ratings were ‘low’ and ‘medium’ [1-6]. Only 4% were high [7-9]. In contrast, when the respondent felt ‘rejuvenated,’ only 70% of the ratings were ‘low’ and ‘medium’ [1-6]. The remaining 30% were high [7-9].

We see from Table 11 that there is there is an association between feeling/emotion and rating one’s likelihood to buy the Sleep-Aid. We just don’t know what the relation is. The next section reveals the nature of the relationship, as we revert back to our old workhorse tool, OLS regression coupled with experimental design.

| Total | Uncertain | Relieved | Healthy | Rested | Rejuvenated | N | |

| Percent | |||||||

| Low = 1-3 | 63 | 83 | 30 | 65 | 38 | 36 | 9039 |

| Medium =4-6 | 23 | 13 | 49 | 13 | 33 | 34 | 12353 |

| High =7-9 | 14 | 4 | 51 | 22 | 29 | 30 | 14448 |

| N | 7090 | 1890 | 1922 | 2175 | 1371 |

Table 11: Association of ratings of interest (column, shown in thirds of the scale) and the feeling/emotion selected (column). The columns add to 100%.

What emotions ‘work’ - Decision criteria change ‘under the influence’

What happens when we divide our data, not by the respondent, but by the feeling/emotion? The respondent was instructed to select one feeling/emotion for each vignette. Let’s sort our 14,448 vignettes into five groups, one group for each feeling/emotion. In a group the vignettes will differ from each other, by design. However, the feeling/emotion will be the same because that’s how the group was constructed in the first place.

What happens when we divide our data, not by the respondent, but by the feeling/emotion? The respondent was instructed to select one feeling/emotion for each vignette. Let’s sort our 14,448 vignettes into five groups, one group for each feeling/emotion. In a group the vignettes will differ from each other, by design. However, the feeling/emotion will be the same because that’s how the group was constructed in the first place.

When we sort the vignettes by feeling/emotion we end up with piles or groups of different sizes. The respondent was instructed to select one of the five feelings/emotions, but not told anything else, e.g. not told to distribute the selection across the different feelings.

Our underlying design for Mind Genomics ensures that at the level of the individual the 36 elements are statistically independent of each other, and that there are so-called zero conditions, i.e., vignettes without any elements. When we combine the data from different respondents, sorting only by the feeling/emotion selected, we destroy some of that elegant balance created by the original design, which had ensured that the elements would appear independently at the level of the individual respondent. Nonetheless, when we create the groups, we can be fairly certain that our up-front design work will make the elements reasonably independent of each other.

Note: When we put the foregoing hypothesis to the test, we compute the pairwise correlations between the 36 elements five times, once for each group or pile of vignettes with a common feeling/emotion. The typical correlation lies between 0.00 and 0.10, making the elements statistically independent.

Let us now create a ‘grand model,’ or better six grand models. Rather than using OLS to estimate the coefficients or impacts of the Interest Model for each respondent, let’s put all the relevant vignettes associated with a particular feeling/emotion into one data set. We then use OLS to estimate the Interest Model.