Case Report

Volume 2 Issue 2 - 2018

Willingness to Pay for the Newly Proposed Social Health Insurance Scheme and Associated Factors Among Civil Servants in Debre Markos Town, North West Ethiopia, 2015

Debre Markos University, Debre Markos, Ethiopia

*Corresponding Author: Belaynesh Abebaw, Debre Markos University, Ethiopia.

Received: June 29, 2018; Published: July 20, 2018

Abstract

Background: Utilization of modern health care services is limited in low income countries compared to developed countries. In Ethiopia, in spite of high burden of preventable disease user-fee charges one of the reasons for low utilization of healthcare services. The government of Ethiopian has developed health insurances strategy to increase the prepaid plan coverage and access to modern health care services.

Objectives: To assess willingness to pay for the newly proposed social health insurance among civil servants in Debre Markos town, East Gojjam, Amhara, Ethiopia, 2015.

Methods: Institution-based cross sectional study was conducted on 421 selected civil servants using simple random sampling technique. Data were collected using semi structured questionnaire. The collected data were entered EPI data version 3.1 and exported to SPSS version 20 for analysis. The result was presented thorough tables, and odd ratio with their respective 95% confidence interval.

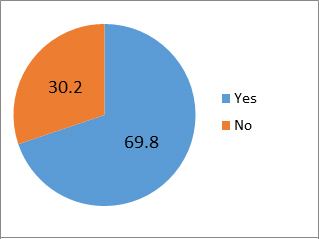

Result: Majority of respondents’, two hundred ninety four (69.8%) of participants were willing to pay the proposed of social health insurance (3%) and only 56 participants were willing to contribute if it is above 3% social health insurance. Marital status being single, no of households with age of 18 years, acceptability of the SHI scheme, and précised quality of services if SHI is implemented were significantly associated with the outcome variable with AOR; 5.1,CI (1.6,16), AOR; 15,CI (0.012,0.347), and AOR ;5.8 CI (0.06,0.506) respectively.

Conclusion: Majority of participants were willing to pay the proposed social health insurance. Marital status being single, No of HH with age of <18 years, acceptability of SHI and perceived quality of services having if SHI is implemented were significantly associated with WTP. Health institution should deliver high quality services, ready in equipment’s, resources and in skilled man power to attain high achievement of the proposed health insurance.

Key word: Willingness; Marital status; Family age; Quality service and acceptability

Introduction

Background: Social Health insurance is a program that pools the risk of several people in an effort to decrease the amount that is paid by an individual at the time health care services are needed. Studies conducted in different parts of Africa and Asia reported that different socio-demographic and economic factors were responsible for low level of willingness to pay (WTP) for Social health insurance [1].

Utilization of modern health care services is limited when compared to developed countries. In Ethiopia, in spite of high burden of preventable disease user-fee charges one of the reasons for low utilization of healthcare services. The government of Ethiopian has developed health insurances strategy to increase the prepaid plan coverage and access to modern health care services. The two types of health insurance schemes were introduced in Ethiopia since 2010 these are social health insurance and CBHI [2].

Social health insurance is in implementation phase and intended to cover 10.46% of the population who are engaged in formal sectors. In Ethiopia, enrolling in SHI is compulsory for all in the formal sectors. This kind of health insurance scheme was expected to be fully implemented in the mid-of 2014 but still in the progress [3]. Furthermore, SHI establishment has been advocated by the World Health Organization as a key to achieving universal coverage of health care and to ensure access to health services, particularly for the disadvantaged in less developed country [4].

In Ethiopia, the coverage with formal health insurance is very minimal, representing only 0.02% to 0.03% of the total population between 1997 and 1998 [5]. Similarly as of 2008, only 1.1% of Ethiopians had any kind of insurance and the government spends 1% of its health expenditure on insurance activities [6].

Statement of the problem

Social health insurance is a central focus of the reforms currently being discussed in many countries in Latin America. The consensus appears to be that the poor should be subsidized and that people should be protected from the large financial risk posed by high-cost illnesses. Public systems go part of the way toward protecting people from large financial risk, but do so with inequities, inefficiency, and inadequate quality [7]. Social security institutions cover the formal sector employed population. One goal of health reforms in the region is to provide access to adequate quality services without imposing high financial risk on the population [8].

Financing that includes cross-subsidization from higher-income to lower-income people. All forms of financing are included in this definition including general tax revenues as well as wage contributions. This criterion also implies the social objective of universal coverage in that a social insurance system that only covers a portion of the population does not completely satisfy the criterion of cross subsidization [9].

A defined covered population: An “ideal” social insurance system knows the people they must provide benefits to and their characteristics (age, gender) [10]. Social insurance goes beyond the Social Security institutions that have traditionally existed in Latin America and beyond the scope of current public systems [11].

Sector-wide social insurance strategies can include Social Security institutions, or other models of financing and delivery can replace them. Most current Social Security institutions do not meet the above definition because Society-wide cross-subsidization of the poor from the rich is not achieved, Universal coverage is not achieved, the health risks of the entire population are not pooled, and the actual number of covered people is not known [12]. As the study conducted in Ethiopia shows, the coverage with formal health insurance is very low.

In order to address this problem and create equitable financing mechanism, the government of Ethiopia is currently undertaking a number of activities to introduce SHI with the overall objective of achieving universal access. Studies conducted in different parts of Africa and Asia reported that different socio demographic and economic factors were responsible for low-level of willingness to pay (WTP) for SHI. However, there was limited empirical evidence on willingness to pay for newly proposed SHI scheme in Ethiopia has been available [13]. Hence, before compulsory SHI Proclamation No.690/2010 comes in to force and is implemented, the study would give insight to policy makers and implementers how to support stakeholder participation and enable informed choice at the individual level [14].

It is essential to assess its feasibility (i.e., its acceptance within the civil servants and its sustainability). Sustainability is determined by the design of the scheme, while acceptability must be tested in community surveys or in pilots through assessment of the people’s willingness to pay (WTP) before fully implementing CBHI. Therefore, the main aim of this study is to assess willingness to pay for the Newly Proposed social health insurance among civil servants in Debre Markos town, East Gojjam.

Justification

The government of Ethiopia introduced a compulsory social health insurance and community based pilot program were implemented. Even though these programs were implemented challenges and success not identified well. It is also stated that about 37% of the expense is a covered out –of-pocket charge which leads to low utilization of health care services. In addition, its late to start and unable initiate on date. So this research will try to identify the possible facto

The government of Ethiopia introduced a compulsory social health insurance and community based pilot program were implemented. Even though these programs were implemented challenges and success not identified well. It is also stated that about 37% of the expense is a covered out –of-pocket charge which leads to low utilization of health care services. In addition, its late to start and unable initiate on date. So this research will try to identify the possible facto

Significance of the study

The study will be used as a baseline data for other researchers, and policy makers to look for the challenges and obstacles that will face during implementation phase. It will also provide information about factors that can either deter or encourage willingness to pay of the Debre Markos town civil servants; thereby maintaining the program acceptability and sustainability. In addition this study will also important for policy makers, decision makers and political leaders to solve all possible obstacles that face during the program implementation phase.

The study will be used as a baseline data for other researchers, and policy makers to look for the challenges and obstacles that will face during implementation phase. It will also provide information about factors that can either deter or encourage willingness to pay of the Debre Markos town civil servants; thereby maintaining the program acceptability and sustainability. In addition this study will also important for policy makers, decision makers and political leaders to solve all possible obstacles that face during the program implementation phase.

Literature review

Government expenditure on health in sub-Saharan Africa has severally been described as being inadequate, insufficient, inequitable and unsustainable [8]. The burden of paying for health care has been a performance indicator for assessment of national health systems according to the World Health Report [15]. Social health insurance in Nigeria has been characterized by a lot of misconceptions, fears about workability of the scheme, concerns as regards workers financial contribution to the scheme overtime and the sincerity of government in financing workers in the formal sector among others [16].

Government expenditure on health in sub-Saharan Africa has severally been described as being inadequate, insufficient, inequitable and unsustainable [8]. The burden of paying for health care has been a performance indicator for assessment of national health systems according to the World Health Report [15]. Social health insurance in Nigeria has been characterized by a lot of misconceptions, fears about workability of the scheme, concerns as regards workers financial contribution to the scheme overtime and the sincerity of government in financing workers in the formal sector among others [16].

Level of awareness about health insurance scheme

There are many studies, conducted in different settings, to evaluate the factors that determine enrolment into SHI or people’s willingness to pay (WTP) for SHI. Potential factors include age, income, education and distance to health facility [17]. The association between age and WTP has been mixed in the literature.

There are many studies, conducted in different settings, to evaluate the factors that determine enrolment into SHI or people’s willingness to pay (WTP) for SHI. Potential factors include age, income, education and distance to health facility [17]. The association between age and WTP has been mixed in the literature.

Respondent’s age is found to have a positive effect on WTP in some studies, while in others it is the opposite. Likewise, distance to the nearest health facility has been found to have a positive effect on WTP in some cases, in the sense that short distance increased the likelihood of WTP, [18] while in others it has had a negative effect [19]. Some studies have shown that household or income has a positive effect on WTP, [20] while others have not found such an effect [21]. Other factors that have been found to significantly influence WTP for SHI programmers include education, household size, level of trust that households have in the management of the insurance program , sex, knowledge of the SHI program and place of residence (urban vs. rural). [22]

About 0.3% of respondents in Nigeria have benefited from the NHIS scheme, while a little over half are willing to participate in the scheme [23]. A study conducted on knowledge, attitudes and opinions of health care providers in Minna town, Nigeria towards the NHIS showed 87.1% was willing to participate in the scheme [24]. A significant association exists between willingness to participate in the NHIS scheme and awareness of methods of options of health care financing and awareness of NHIS [16].

A study conducted in Wolita Sodo, Ethiopia showed that more than half (55.2%) of the teachers have never heard of the health insurance scheme. The two most commonly stated reasons for not willing to pay the proposed social health insurance scheme were fear of poor implementation and that the scheme might not cover all needed services for 65 (69.1%) and 25 (26.6%) of teachers respectively [3].

Even though more than half (55.2%) of the teachers in this study have not ever heard of the proposed health insurance scheme. Of these, 74.4% were willing to pay. Moreover, 47.1% of the willing were ready to contribute greater than or equals to 4% of their monthly salary as a monthly premium. The study done in Accra, Ghana, in 2002, and the one done in Nigeria in 2010 where willingness to pay was 6%, but the study done in Kampala District, Uganda, where willingness to pay was 4% [25-27].

A study done in Ethiopia showed out of the total of 328 teachers, 129 (39.3%) had at least one episode of illness of those who experienced at least one episode of illness over the past two months before the survey, 113 (87.6%) used out of pocket money, 12 (9%) used borrowed money, and the remaining used government fee as a source of payment for medical expenses [3].

Willingness to pay for social health insurance

One hundred seventy four (74.4%) were willing to pay for the scheme. Out of 174 teachers who were willing to pay more than half (47.1%) of them were willing to contribute greater than or equal to 4% of their monthly salary as a premium. About one fourth of the respondents stated that they would not be willing to pay anything. Out of 60 teachers who were not willing to pay, 35 (58.3%), 17 (28.3%), and 8 (13.3%) stated that it was the government’s responsibility to finance the program, out of pocket payment is better, and contribution being non-refundable respectively as reasons for not willing to pay [3].

One hundred seventy four (74.4%) were willing to pay for the scheme. Out of 174 teachers who were willing to pay more than half (47.1%) of them were willing to contribute greater than or equal to 4% of their monthly salary as a premium. About one fourth of the respondents stated that they would not be willing to pay anything. Out of 60 teachers who were not willing to pay, 35 (58.3%), 17 (28.3%), and 8 (13.3%) stated that it was the government’s responsibility to finance the program, out of pocket payment is better, and contribution being non-refundable respectively as reasons for not willing to pay [3].

Another study in Ethiopia also revealed that the average willingness to pay of respondents for compulsory health insurance scenario is 57.94 ETB per month which is much lower than the national average household health care expenditure. This shows that the average willingness to pay for compulsory health insurance is almost half of the average household monthly health care expenditure in Ethiopia [28].

Predictors of willingness to pay for social health insurance

A study done in Wolita Sodo Ethiopia showed that Respondents who had first degree were more likely to be willing to pay as compared to those teachers who were diploma holders. Those teachers who were unmarried were more likely to be willing to pay for the SHI scheme as compared to married counterparts. It was also found that respondents who experienced problem of paying for medical bill over the past 12 months preceding the survey were more likely to be willing to pay for the SHI scheme as compared to those who didn’t. Moreover, individuals who heard about health insurance scheme were more likely to be willing to pay as compared to those teachers who have never heard [3].

A study done in Wolita Sodo Ethiopia showed that Respondents who had first degree were more likely to be willing to pay as compared to those teachers who were diploma holders. Those teachers who were unmarried were more likely to be willing to pay for the SHI scheme as compared to married counterparts. It was also found that respondents who experienced problem of paying for medical bill over the past 12 months preceding the survey were more likely to be willing to pay for the SHI scheme as compared to those who didn’t. Moreover, individuals who heard about health insurance scheme were more likely to be willing to pay as compared to those teachers who have never heard [3].

Furthermore, educational status of the respondent was one of the strong predictors for WTP. Findings of Barnighausen on willingness to pay for social health insurance among informal sectors workers in Wuhan, China [29] and another study in china showed respondents with higher education were more willingness to pay for social health insurance [30].

A study done on analysis private health insurance purchasing decision with NHIS in Taiwan [31], and extending social health in Kenya showed participants who got married were more likely to be willingness to pay (WTP) social health insurance [32].

A study done in Wolita Sodo Ethiopia found that people who never got married were more likely to be WTP for the SHI scheme as compared to married counterparts. This finding is intuitively sensible since any increase in the household size while holding the income constant reduces the per capita income. However, sex was not found to be significant predictor of WTP for the scheme [3].

Another study in Ethiopia showed that respondents with low income were willing to pay less for compulsory health insurance. Willingness to pay was higher for households with at least one member with chronic illness and if there was at least one person who needed health care 12 months prior to the interview. Age, sex, relation to the head of the household, family size, number of children under 5 years of age and past insurance experience did not show significant association with willingness to pay for compulsory health insurance. Households with elderly aged 65+ were willing to pay less [32].

Previous conducted research on the primarily on the community based health insurance were not considered customers wage. The aim of this study is to assess willingness to pay on social health insurance which is primarily based on compulsory and wage based. The compulsory based health insurance willingness to pay for the specified amount is not studied so this research was try to assess civil servant willingness towards social health insurance. Furthermore, a possible factor that may affect willingness towards social health insurance was also being studied.

Conceptual Framework

Factors identified to influence willingness to pay in the health prepayment schemes are presented below in this framework. Three basic divisions or levels are identified the civil servants, the individual and the ‘product’ of the interaction between the individual which produces the valuation of interest. Within these divisions, various blocks are presented as well as the manner by which they are possibly interlinked.

Factors identified to influence willingness to pay in the health prepayment schemes are presented below in this framework. Three basic divisions or levels are identified the civil servants, the individual and the ‘product’ of the interaction between the individual which produces the valuation of interest. Within these divisions, various blocks are presented as well as the manner by which they are possibly interlinked.

- Demographic factors,

- Health related factors,

- Socioeconomic factors,

- and other factors

Influence the amount households are willing to pay for the establishment of the social prepayment scheme. These factors have to be evaluated by the household based on certain probabilistic statements such as the number of household members, the state of health of household members, level of income wealth, experience with other forms of prepayment schemes, level of education attained, experiences with illness, certainty about the scheme etc.

Socioeconomic factors such as income, employment level, and level of education influence the health status of household members. This is because the rich can easily afford better health care services than the poor. Therefore, the poor suffer more from ill health than the non-poor. More educated individuals are likely to know the benefits from investing in health care than the less educated.

Objectives

General objective

To assess willingness to pay for the newly proposed social health insurance scheme and associated factors among civil servants in Debre Markos Town, Northwest Ethiopia 2015.

To assess willingness to pay for the newly proposed social health insurance scheme and associated factors among civil servants in Debre Markos Town, Northwest Ethiopia 2015.

Specific objectives

- To determine the level of willingness to pay for SHI scheme among civil servants in Debre Markos Town.

- To identify associated factors for willingness to pay for SHI among civil servants in Debre Markos Town

Methods and Materials

Study design

Institutional-based cross sectional study design was conducted.

Institutional-based cross sectional study design was conducted.

Study area and period

The study was conducted from February 15/2015 - April 15/2015 in Debre Markos town that is found at 265 km north of Bahir-Dar and 299 Northwest of Addis Ababa, in Amhara Regional state. The town has 7 kebeles and has total population of 101,734; of whom 50664 are men and 51070 are women. There are four health centers and 1 hospital and in 22 private clinics in the town. A total of 1587civil servant in 17 formal sectors [34]

The study was conducted from February 15/2015 - April 15/2015 in Debre Markos town that is found at 265 km north of Bahir-Dar and 299 Northwest of Addis Ababa, in Amhara Regional state. The town has 7 kebeles and has total population of 101,734; of whom 50664 are men and 51070 are women. There are four health centers and 1 hospital and in 22 private clinics in the town. A total of 1587civil servant in 17 formal sectors [34]

Source population

All civil servant workers who were working in civil servant sectors in Debre Markos Town

All civil servant workers who were working in civil servant sectors in Debre Markos Town

Study population

All civil servants who were working in selected sectors were study population.

The study units were selected individuals in the selected sectors

4.5 Inclusion and Exclusion criteria:

Inclusions criteria: Civil servants who were available at time of data collection

Exclusion criteria: civil servants employed for contract period, sectors which were under supervision of federal and regional level

All civil servants who were working in selected sectors were study population.

The study units were selected individuals in the selected sectors

4.5 Inclusion and Exclusion criteria:

Inclusions criteria: Civil servants who were available at time of data collection

Exclusion criteria: civil servants employed for contract period, sectors which were under supervision of federal and regional level

Sample size determination

The required sample size was computed using single population proportion formula assuming previous study on willingness to pay for social health insurance among teachers done in Wolita Sodo zone, Ethiopia was 47% (3), 95% Confidence interval (1.96), and margin of error (5%).

n = z2 p (1-p), n= (1.96)2x (0.47) = 383

d2 (0.05)2

With a 10% non-response rate, the total sample size is 421

The required sample size was computed using single population proportion formula assuming previous study on willingness to pay for social health insurance among teachers done in Wolita Sodo zone, Ethiopia was 47% (3), 95% Confidence interval (1.96), and margin of error (5%).

n = z2 p (1-p), n= (1.96)2x (0.47) = 383

d2 (0.05)2

With a 10% non-response rate, the total sample size is 421

Sampling procedure

Simple random sampling technique was used to select study participants. After having a list of civil servants from Debre Markos civil service human resource office a simple random sampling technique was performed. A total of 17 government sectors found in the town, 50% (8 sectors) were selected randomly. The total sample size was selected by proportionally allocated from each of the number of civil servants from each secretor. The total sample size of 421 was selected.

Simple random sampling technique was used to select study participants. After having a list of civil servants from Debre Markos civil service human resource office a simple random sampling technique was performed. A total of 17 government sectors found in the town, 50% (8 sectors) were selected randomly. The total sample size was selected by proportionally allocated from each of the number of civil servants from each secretor. The total sample size of 421 was selected.

Variables

- Dependant Variables: - Willingness to pay (WTP)

- Independent variables

Demographic factors: Sex, age, marital status and occupation.

Socio-economic factors: Income, wealth, employment and level of education.

Health and health related issues

Self-reported health status of the house hold, Persons with chronic illness/disability in the household, Seek medical treatment, and get treatment, Place of treatment, reasons for going treatment, distance of health facility, coverage of the health care, satisfaction with health care services and costs, coverage of the households for covering health care costs, Means of getting money for health care, borrowing money for medication costs within last year.

Self-reported health status of the house hold, Persons with chronic illness/disability in the household, Seek medical treatment, and get treatment, Place of treatment, reasons for going treatment, distance of health facility, coverage of the health care, satisfaction with health care services and costs, coverage of the households for covering health care costs, Means of getting money for health care, borrowing money for medication costs within last year.

Data collection Tool and procedure

Data Collection Tool

The data collection tools were developed from reviewing different literatures with some modification. Data were collected using semi structured pre-tested questionnaire. The questionnaire was prepared in English and translated to Amharic, as the study participants speak Amharic. The questionnaire was translated back to English by another person to check for consistency. The questionnaire consists of four sections, socio-demographic variables (age, sex, marital status, religion, monthly income, educational status and occupation), it was measured by using eleven items, and contained questions of assessing health status and treatment that contains fifteen questions, assessing information on payment and coping mechanism of respondents (2 questions), acceptability of social health insurance scheme (4 questions) and willingness to pay for social health insurance (5 questions).

Data Collection Tool

The data collection tools were developed from reviewing different literatures with some modification. Data were collected using semi structured pre-tested questionnaire. The questionnaire was prepared in English and translated to Amharic, as the study participants speak Amharic. The questionnaire was translated back to English by another person to check for consistency. The questionnaire consists of four sections, socio-demographic variables (age, sex, marital status, religion, monthly income, educational status and occupation), it was measured by using eleven items, and contained questions of assessing health status and treatment that contains fifteen questions, assessing information on payment and coping mechanism of respondents (2 questions), acceptability of social health insurance scheme (4 questions) and willingness to pay for social health insurance (5 questions).

Data collection procedure

The data collection process was take place from February 15/2015-April 15/2015 by using semi structured Pre-tested questionnaires. The questionnaires were prepared in English and then translate into Amharic by two different persons proficient in both languages. Three health diploma graduated nurses from Debre Markos town were used for data collection after proper training and orientation was given for data collectors after one day training on the objectives of the study and the contents of data collection tools. The investigator and the supervisors were supervised the data collection process on daily base.

The data collection process was take place from February 15/2015-April 15/2015 by using semi structured Pre-tested questionnaires. The questionnaires were prepared in English and then translate into Amharic by two different persons proficient in both languages. Three health diploma graduated nurses from Debre Markos town were used for data collection after proper training and orientation was given for data collectors after one day training on the objectives of the study and the contents of data collection tools. The investigator and the supervisors were supervised the data collection process on daily base.

Data Quality control

Pre-test was done in adjacent and similar town of Amanuel on 20 people. The data collection process was supervised by the investigators and supervisors after proper training given for 3 data collector and 2 supervisors. Data completeness and consistency was also verifying using cross-tabulation. Moreover, the collected data were clean, code and enter to EPI data version 3.1.

Pre-test was done in adjacent and similar town of Amanuel on 20 people. The data collection process was supervised by the investigators and supervisors after proper training given for 3 data collector and 2 supervisors. Data completeness and consistency was also verifying using cross-tabulation. Moreover, the collected data were clean, code and enter to EPI data version 3.1.

Data analysis

Data were coded, entered in to EPI data v.3.1 2002 statistical package was exported to SPSS version 20 statistical package for analysis. A descriptive statistical analysis was used to describe the descriptive findings. Binary logistic regression was logistic fitted to identify factors associated with outcome variable. The crude and adjusted odds ratios with their corresponding 95% confidence intervals were computed. Variables which have p-value less than 0.25 bivariate analysis was taken in to multivariable analysis and expressing the estimate analysis of willingness to pay for social health insurance by using contingent valuation method. A p-value < 0.05 was considered to declare a statistically significant association with dependent and selected independent variables. The results were presented in text and tables based on the type of data.

Data were coded, entered in to EPI data v.3.1 2002 statistical package was exported to SPSS version 20 statistical package for analysis. A descriptive statistical analysis was used to describe the descriptive findings. Binary logistic regression was logistic fitted to identify factors associated with outcome variable. The crude and adjusted odds ratios with their corresponding 95% confidence intervals were computed. Variables which have p-value less than 0.25 bivariate analysis was taken in to multivariable analysis and expressing the estimate analysis of willingness to pay for social health insurance by using contingent valuation method. A p-value < 0.05 was considered to declare a statistically significant association with dependent and selected independent variables. The results were presented in text and tables based on the type of data.

Operational definition

Willingness to pay: Voluntariness of study participants to pay the determined payment for the newly proposed social health insurance.

Willingness to pay: Voluntariness of study participants to pay the determined payment for the newly proposed social health insurance.

Ethical Considerations

Ethical clearance was obtained from the ethical clearance review bored of college of medicine and health sciences, Debre Markos University. Written permission was taken from the respective administration of District and school. Informed consent was taken from the study participants. Privacy and confidentiality was maintained throughout the study period; each questionnaire was coded without any personal identification.

Ethical clearance was obtained from the ethical clearance review bored of college of medicine and health sciences, Debre Markos University. Written permission was taken from the respective administration of District and school. Informed consent was taken from the study participants. Privacy and confidentiality was maintained throughout the study period; each questionnaire was coded without any personal identification.

Result

Socio demographic Characteristics of respondents

A total 421 respondents were willing and able to participate in this study with overall response rate of 100%. Majority, 164 (39%) of respondents were belongs to age group of 20-30 years and the median age of respondents was 32 years and rang 42. Majority, 256 (60.8%) of the participants were male and two hundred seventy one (64.4%) of the respondents were married. Almost all, 407 (96.7%) of respondents were followers of orthodox Christians. Majority, 176 (41.3%) of respondents had monthly of 1501-2000 ETB with the mean of respondent income was 2487 (SD ± 1199.19). Three hundred sixteen (75.1%) of respondents reported as they had less than five family size with the average of respondents family were 4 (± 1.86 SD).

A total 421 respondents were willing and able to participate in this study with overall response rate of 100%. Majority, 164 (39%) of respondents were belongs to age group of 20-30 years and the median age of respondents was 32 years and rang 42. Majority, 256 (60.8%) of the participants were male and two hundred seventy one (64.4%) of the respondents were married. Almost all, 407 (96.7%) of respondents were followers of orthodox Christians. Majority, 176 (41.3%) of respondents had monthly of 1501-2000 ETB with the mean of respondent income was 2487 (SD ± 1199.19). Three hundred sixteen (75.1%) of respondents reported as they had less than five family size with the average of respondents family were 4 (± 1.86 SD).

| Variable | Frequency | Percent |

| Age | ||

| 20-30 years | 164 | 39 |

| 31-41 | 34 | 8.1 |

| 42-52 | 121 | 28.7 |

| 53-63 | 73 | 17.3 |

| > 64 | 29 | 6.9 |

| Sex | ||

| Male | 256 | 60.8 |

| Female | 165 | 39.2 |

| Marital status | ||

| Married | 271 | 64.4 |

| Single | 128 | 30.4 |

| Widowed | 12 | 2.9 |

| Separated | 5 | 1.2 |

| Divorced | 5 | 1.2 |

| Religion | ||

| Orthodox | 407 | 96.7 |

| Muslim | 5 | 1.2 |

| Protestant | 9 | 2.1 |

| Income | ||

| 600-1000 | 13 | 3.1 |

| 1001-1500 | 32 | 7.6 |

| 1501-2000 | 176 | 41.8 |

| 2001-2500 | 140 | 33.3 |

| >2501 | 60 | 14.3 |

| Family size | ||

| 1-4 | 316 | 75.1 |

| > 5 | 105 | 24.95 |

Table 1: Socio demographic characteristics for willingness to pay the proposed

social health insurance among civil servants in Debremarkos Town, 2015.

A total 421 respondents were willing and able to participate in this study with overall response rate of 100%. Majority, 164 (39%) of respondents were belongs to age group of 20-30 years and the median age of respondents was 32 years and rang 42. Majority, 256(60.8%) of the participants were male and two hundred seventy one (64.4%) of the respondents were married. Almost all, 407(96.7%) of respondents were followers of orthodox Christians. Majority, 176(41.3%) of respondents had monthly of 1501-2000 ETB with the mean of respondent income was 2487 (SD + 1199.19). Three hundred sixteen (75.1%) of respondents reported as they had less than five family size with the average of respondents family were 4 (+ 1.86 SD). Table 1. Socio demographic characteristics for willingness to pay the proposed social health insurance among civil servants in Debremarkos Town, 2015.

Payment and payment coping mechanisms of respondents

Majority of respondents, 361 (85.7%) were decision maker in the house or household head in the family while 60 participants were member in the family. One hundred ninety four (46.3%) participants mentioned that they were encountered an illness in the past 4 weeks in the family. Of this who encountered an illness in the four weeks, the most recent illness were malaria 13 (3.1%), typhoid 55 (13.1%), diarrhea 12 (2.9%) and 114 (27.1%) were others.

Majority of respondents, 361 (85.7%) were decision maker in the house or household head in the family while 60 participants were member in the family. One hundred ninety four (46.3%) participants mentioned that they were encountered an illness in the past 4 weeks in the family. Of this who encountered an illness in the four weeks, the most recent illness were malaria 13 (3.1%), typhoid 55 (13.1%), diarrhea 12 (2.9%) and 114 (27.1%) were others.

Out of the total of 421 participants, 194 had at least one episode of illness over the pasts 4 weeks preceding the survey. Of those who experienced at least one episode of illness over the past two months before the survey, 113 (87.6 %) used out of pocket money, 12 (9%) used borrowed money, and the remaining used government fee as a source of payment for medical expenses. Out of 194 participants who had one episode of illness, the duration of illness were lasts below seven days for 151 participants and above seven for 43 participants. One hundred nighty three Participants were seek a treatment and their first choice were traditional treatment 31 (7.4%), public health facilities 112 (26.6%), private clinics 41 (9.7), self-treatment 6 (1.4%) and 5 (0.7%) did nothing.

Although participants cope the payment and seek treatment 52 (26.8%) participants did not recover from their illness and seek another treatment. Their second treatments choices after their first treatment were private clinics and traditional healers.

| Variables | Frequency | % |

| Decision makers on house hold money spent | ||

| Yes | 361 | 85.7% |

| No | 60 | 14.3% |

| Illness family in the past 4wks | ||

| Yes | 194 | 46.3% |

| No | 227 | 53.9% |

| Most recent type of illness | ||

| Malaria | 13 | 3.1 |

| Typhoid | 55 | 13.1 |

| Diarrhea | 12 | 2.9 |

| Others | 114 | 27.1 |

| Duration of illness lasts | ||

| <=7 days | 151 | 77.8 |

| >7 days | 43 | 22.2 |

| Source of money/way of payment coping | ||

| Out of pocket | 113 | 58.24 |

| Borrowed | 12 | 6.1 |

| Government fee | 69 | 35.5 |

| First treatment seek | ||

| Traditional healers | 31 | 7.4 |

| Public health facility | 112 | 26.6 |

| Private clinic | 41 | 9.7 |

| Self-care | 6 | 1.4 |

| Did nothing | 5 | 0.7 |

Table 2: Payment and payment coping mechanisms for willingness to pay the proposed

social health insurance among civil servants in Debre Markos Town, 2015.

Responsibility to finance the program, out of pocket payment is better, and contribution being non-refundable respectively as reasons for not willing to pay.

Acceptability of social health insurance scheme of respondents

Two hundred fourteen study participants replied that social health insurance as acceptable strategy for paying health care. In addition, majority 266 (63.2%) responded that SHI protects financially from unexpected costs of illness, and 212 (50.4%) and 245 (58.2%) participants also responded that SHI improve quality of services and household health consumption respectively. 5.4. Willingness to pay (WTP) for social health insurance of respondents. Out of 421 participants, two hundred ninety four (69.8%) of participants were willing to pay the proposed of social health insurance 3% and only 56 participants were willing to contribute if it is above 3% social health insurance. Out of 127 government employee who were not willing to pay, 65 (51%), 50 (39%), and 16 (12.5%) stated that it was the government’s responsibility to finance the program, out of pocket payment is better, and contribution being non-refundable respectively as reasons for not willing to pay.

Two hundred fourteen study participants replied that social health insurance as acceptable strategy for paying health care. In addition, majority 266 (63.2%) responded that SHI protects financially from unexpected costs of illness, and 212 (50.4%) and 245 (58.2%) participants also responded that SHI improve quality of services and household health consumption respectively. 5.4. Willingness to pay (WTP) for social health insurance of respondents. Out of 421 participants, two hundred ninety four (69.8%) of participants were willing to pay the proposed of social health insurance 3% and only 56 participants were willing to contribute if it is above 3% social health insurance. Out of 127 government employee who were not willing to pay, 65 (51%), 50 (39%), and 16 (12.5%) stated that it was the government’s responsibility to finance the program, out of pocket payment is better, and contribution being non-refundable respectively as reasons for not willing to pay.

Contributing factors remained to be significantly and independently associated with SHI and have an overall significant effect on SHI at 5% level of significance (Families who had children with age of 18 years, marital status, acceptability of health insurance and awareness to the use of social health insurance on quality of services).

Participants who were single were 5.1 times more likely willing to pay the proposed social health insurance than married one AOR: 5.1, CI [1.6,16]. Study participants who had less than 3 under 18 year age children were 8.9 more likely willing to pay the proposed social health insurance than who had greater than three children. Participants who said social health insurance can improve quality of services were 5.8 times more likely to be willing compared to that didn’t. In addition, study participants who accept social health insurance as a strategy were 15 times more willing to pay the proposed social health insurance than who didn’t accept SHI as a strategy. (Table 2)

Figure 1: Prevalence of willingness to pay for social health insurance among

civil servants in Debre Markos town, East Gojjam,Northwest, Ethiopia, 2015.

Factors associated with WTP In bivarate analysis, all independent variables were entered in to the model. The model showed that variables that were associated with outcome variable were having children less than with the age of 18 years, marital status, age of respondent, recent type of illness, acceptability of health insurance scheme and awareness to the use of social health insurance on financial protection, household health consumption and quality of service.

Consequently, the multivariable logistic regression analysis was used by taking all the six associated variables into account simultaneously and only three of the most this study revealed that 69.8% of participants were willing to pay contribute 3% of their monthly salary as a monthly premium. This was similar to a study conducted in Wolita Sodo, Ethiopia which was 52.9% contribute 3% from their monthly salary.

| Variables | Willingness to pay. | COR (95% CI) | AOR (95% CI) | P-value | |

| Yes | No | ||||

| Marital status (N = 421) | |||||

| Married | 200 | 71 | 1 | 1 | |

| Single | 77 | 51 | 1.8 (1.19,2.9) | 5.1 (1.6,16) | 0.005 |

| Widowed | 10 | 3 | 0.84 (.226,3.1) | 6.2 (0.52,73) | |

| Divorced | 7` | 2 | 0.79 (0.16,3.9) | 14.5 (0.43,46) | |

| No of HH < 18 years (N = 302) | |||||

| <3 | 205 | 69 | 1 | 1 | |

| >3 | 16 | 12 | 2.2 (1.05,4.9) | 8.9(1.67,47) | 0.01 |

| Acceptability of SHI as a strategy (N = 421) |

|||||

| Yes | 146 | 148 | 1 | 1 | |

| No | 120 | 7 | 0.58 (.03,.13) | 0.07(0.012,0.34) | 0.01 |

| SHI improved HH health consumption (N = 421) | |||||

| Yes | 127 | 167 | 1 | ||

| No | 118 | 9 | 0.58 (0.028,0.12) | ||

| SHI improve quality of services (N = 421) | |||||

| Yes | 104 | 190 | 1 | 1 | |

| No | 108 | 19 | 0.96 (.056,0.16) | 0.17(.06,.506) | 0.001 |

| Financial protection against cost of illness (N = 421) | |||||

| Yes | 100 | 194 | 1 | ||

| No | 114 | 13 | 0. 059 (.032,.11) | ||

Table 3: Factors associated with willingness to pay for social health insurance

among civil servants in Debre Markos Town, North West Ethiopia, 2015.

The two most commonly stated reasons for not willing to pay the proposed social health insurance scheme were fear of poor implementation and that the scheme might not cover all needed services. But, this finding was lower than the study done in Accra, Ghana, in 2002, and the one done in Nigeria in 2010 where willingness to pay was 6%, but higher than the study done in Kampala District, Uganda, where willingness to pay was 4% [11,12,14]. This difference might be caused by differences in the benefit packages that the schemes cover. This study found that people who never got married were 5.2 times more likely to be WTP for the SHI scheme as compared to married counterparts. This finding was greater than a study done in Wolita Zone South Ethiopia that those who never got married were 2.7 times more likely to be WTP than compared to married counterparts. In contrary, a study done in osuan, Nigeria reveled that marital status was found to increases WTP by 51%.i.e. married head of households were more WTP than the single and divorced (15). That is may be due to different setup and methodology that used.

In this study socio demographic factors like age and income were not significant factors but in another study conducted in Osuna, Nigeria [15], and in Ethiopia [16]. In this study majority of respondents, 361 (85.7%) were decision maker in the house head in the family while 60 participants were member in the family. One hundred ninety four (46.3%) participants mentioned that they were encountered an illness in the past 4 weeks in the family. Of this who encountered an illness in the four weeks, the most recent illness were malaria 13 (3.1%), typhoid 55 (13.1%), diarrhea 12 (2.9%) and 114 (27.1%) were others.

A study done in Wolita Zone South Ethiopia showed out of the total of 328 study participants, 129 (39.3%) had at least one episode of illness of those who experienced at least one episode of illness over the past two months before the survey, 113 (87.6%) used out of pocket money, 12 (9%) used borrowed money, and the remaining used government fee as a source of payment for medical expenses [3].

In addition, these study participants who accept social health insurance as a strategy were 15 times more willing to pay the proposed social health insurance than who didn’t accept SHI as a strategy. This study complemented by a study conducted in Nigeria which showed participants who had awareness of social health insurance scheme were more likely to participants [12].

Limitation

Thais study were limited to address civil servant workers who were working in civil servant sectors in Debere Markos Town, while civil servants who were under supervision of federal and regional level were not included.

Thais study were limited to address civil servant workers who were working in civil servant sectors in Debere Markos Town, while civil servants who were under supervision of federal and regional level were not included.

Conclusion

Generally, more than half percent participants were willing to pay the proposed social health insurance. Variables that were significantly associated with WTP were: marital status being single, No of HH with age of < 18 years, acceptability of SHI and perceived quality of services having if SHI is implemented.

Recommendation

To health insurance agency:

To health insurance agency:

- Health insurance agency should provide information about the importance of health insurance and how to protect them unconditional pay.

- Mobilization about SHI importance to attain high achievement of the proposed social health insurance or to increase willingness to pay the proposed social health before compulsory social health insurance is implemented.

To health institution

Further study needs to be conducted to explore factors associated with willingness to pay.

- Health institution should deliver high quality services.

- It should be full filled by essential drugs, equipments, and in skilled man power to attain high achievement of the proposed health insurance.

Further study needs to be conducted to explore factors associated with willingness to pay.

References

- Melaku H., et al. “Willingness to pay community-based health insurance among rural households of Debub Bench District, Bench Maji Zone, Southwest Ethiopia”. BMC Public Health (2014).

- Tesfamichael A., et al. “Willingness to join and pay for the newly proposed social health insurance among teachers in wolaitasodo town, south Ethiopia.” Ethiopian Journal of Health Sciences 24.3 (2014): 195-202.

- Hsiao WC and Shaw RP. “Social health insurance for developing nations”. Washington: the international bank for reconstruction and development. The World Bank (2007).

- De Allegri M., et al. "To enroll or not to enroll?” A qualitative Investigation of demand for health insurance in rural West Africa”. Social Science & Medicine62.6 (2006):1520-1527.

- McIntyre D., et al. “Promoting equitable health care financing in the African context: Current challenges and future prospects”. Global Forum for Health Research(2007): 45-48.

- Damen H. “Exploring alternatives for financing health care in Ethiopia: An introductory Review article”. Ethiopian Journal of Health Development15.3(2001):153-163.

- Federal Ministry of Health Planning and Programming Department Health Insurance Strategy. Addis Ababa (2008):13-17.

- USAID Social health insurance assessment tools, as well as on the review of the many models that exist of community (2010).

- Anali 25 Joint Learning Network. Ghana: National Health Insurance Scheme (NHIS). Willingness to pay for health insurance in a developing economy, (1997): 223-237.

- Zhao DH., et al. “Coverage and utilization of the health insurance among migrant workers in Shanghai, China”. Chinese Medical Journal 124.15 (2011): 2328-2334.

- Kong Y., et al. “Disparities in medical expenditure and outcomes among patients with intracranial hemorrhage associated with different insurance statuses”. In south western. Acta Neurochirurgica Supplement (2011): 337-341.

- Mensah SA. The National Health Insurance Scheme in Ghana: overview and status of implementation. National Health Insurance Authority site visit briefing; Accra, Ghana; May 21, 2012.uthwestern China. Act Neurotic Suppl. (2011): 337- 341.

- Zhang L., et al. “Social capital and farmer's willingness-to-join a newly established community-based health insurance in rural China”. Health policy 76.2 (2006): 233-242.

- Liu T., et al. “An Analysis of Private Health Insurance Purchasing Decision with National Health Insurance in Taiwan”. Social Science and Medicine Journal 55.5 (2002): 755-774.

- Hoare G. Policies for financing the health sector health policy and planning 2.1 (1987):1-16.

- Werner D. The build up to the crisis. Contact, services in southeast Nigeria. Health Policy, (1995): 1-4.

- Asenso-Okyere WK., et al. “Willingness to pay for health insurance in a developing economy. A pilot study of the informal sector of Ghana using contingent valuation”. Health Policy 42.3 (1997): 223-237.

- Asgary A., et al. “Estimating rural households’ willingness to pay for health insurance”. The European Journal of Health Economics 5.3 (2004): 209-215.

- Dong H., et al. “Willingness-to-pay for community based insurance in Burkina Faso”. Health economics 12.10 (2003): 849-862.

- Ataguba J., et al. “Estimating the willingness to pay for community healthcare insurance in rural Nigeria”. (2008).

- Donfouet HPP., et al. “The determinants of the willingness-to-pay for community-based prepayment scheme in rural Cameroon”. International Journal of Health Economics and Management 11.3 (2011): 209-220.

- Onwujekwe O., et al. “Willingness to pay for community-based health insurance in Nigeria: do economic status and place of residence matter?” Health Policy Plan 25.2 (2010):155-161.

- Olugbenga-B. “Attitude of Civil Servants towards to social health insurance”. Nigerian Journal of Clinical Practice 13.4 (2010).

- Mathauer I., et al. “Extending social health insurance to the Informal sector in Kenya. An assessment of factors affecting demand.” The International Journal of Health Planning and Management 23.1 (2008): 51-68.

- Louis Peter SA. “Orthodontic attitudes toward national health insurance”. American Journal of Orthodontics 75.5 (1979): 562-568.

- Akpala C and Onuekwusi N. Awareness and Perception of National Health Insurance Scheme among Nigerian Health Care Professionals, (1988).

- Sabitu K and James E. “Knowledge, attitudes and opinions of health care providers in Minnatown towards the national health insurance scheme (NHIS)”. Annals of Nigerian Medicine 1.2 (2005): 9-13.

- Gertler P. “On the Road to Social Health Insurance”. World Development 26.4 (1998): 717-732.

- Byabashaija AA. “The knowledge and views of teachers in government educational institutions in Kampala district on the proposed social health insurance scheme in Uganda”. UMU Press 7.1 (2009): 1-9.

- Osungbade KO., et al. “Social Health Insurance in Nigeria: Policy Implications in a Rural Community”. Nigerian Medical Practitioner 57. (5-6) (2010): 90-95.

- Shimeles O., et al. “Indigenous community insurance (Iddirs) as an alternative health care financing in Jimma city, southwest Ethiopia”. Ethiopian Journal of Health Sciences (2009): 53-60.

- Barnighausen T., et al. “Willingness to pay for social health insurance mongo informal sector workers in Wuhan, China: a contingent valuation study”. BMC Health Services Research(2007).

- John.E, Hyacinth E, and William M. May (2008). (University of Nigeria)

- Debre Markos town administration human resource and finance office planning and programming service. Annual plan 2007E.C

Citation:

Belaynesh Abebaw., et al. “Willingness to Pay for the Newly Proposed Social Health Insurance Scheme and Associated Factors

Among Civil Servants in Debre Markos Town, North West Ethiopia, 2015”. Medical Research and Clinical Case Reports 2.2 (2018): 164-177.

Copyright: © 2018 Belaynesh Abebaw., et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Scientia Ricerca is licensed and content of this site is available under a Creative Commons Attribution 4.0 International License.

Scientia Ricerca is licensed and content of this site is available under a Creative Commons Attribution 4.0 International License.